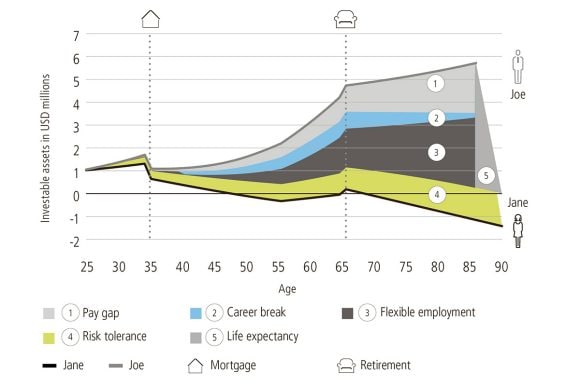

Learn how women face a different financial life journey to men and how to ensure the outcome towards the end of their lives is not negatively impacted as a result. By managing investments wisely women can narrow the gender wealth gap that can persist towards the end of their lives.

How much of a gap do gender differences create in women’s finances?

UBS Wealth Way

Our research shows almost 60% of women do not engage in the most important aspects of financial well-being: investing, insurance, retirement and long-term planning.

With our proven Wealth Way three step consulting approach we help you create a financial plan to achieve your life goals, so you can minimize Jane's situation illustrated above.

It starts with a conversation and questions to uncover what’s important to you: your financial goals, values and legacy.

We’ll jointly determine three strategies – liquidity, longevity, and legacy – and tailor them to your short- and long-term goals in life.

Recommended to you

Your capital is at risk. The value of an investment may fall as well as rise and you may not get back the original amount.

UBS does not provide tax or legal advice. You should consult your independent tax/legal advisor for specific advice before entering into or refraining from entering into any services or investments.