06 March 2019

Our recent UBS Investor Watch, “Own your worth,” explores how women around the world approach their financial well-being. Are they fully engaged in the financial decisions that affect them? And if not, why not?

Our recent UBS Investor Watch, “Own your worth,” explores how women around the world approach their financial well-being. Are they fully engaged in the financial decisions that affect them? And if not, why not?

The answers are surprising.

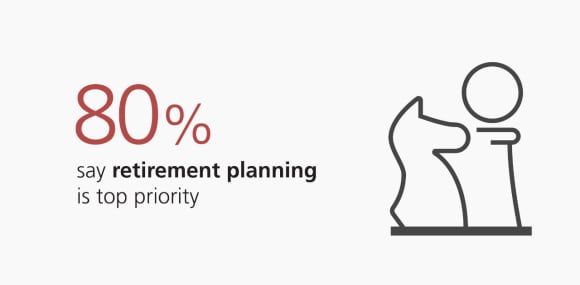

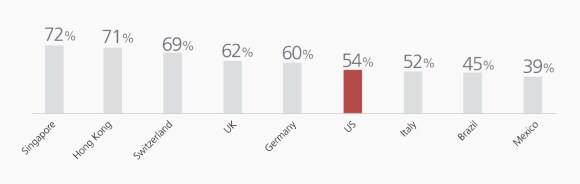

Almost all women globally are highly involved in everyday finances, like expenses and bill paying. But almost 60%* of women do not engage in the most important aspects of their financial well-being: investing, insurance, retirement and other long-term planning.

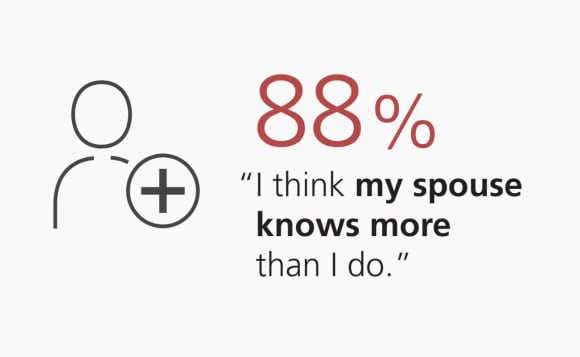

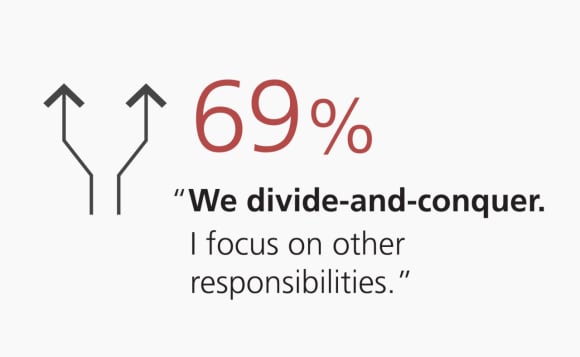

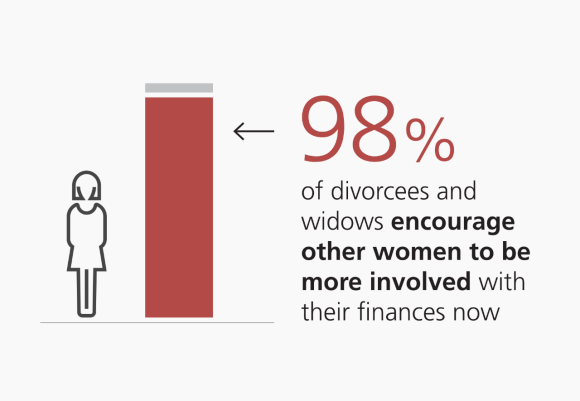

Why do so many women focus on the present but ignore the future? In the US, women opt out of long-term financial decisions because they believe their spouses know more. Regardless of the rationale, failing to plan for the future carries risk. As women around the world live longer, the likelihood of becoming widowed or divorced increases. Inevitably, women who plan for these possibilities will be better prepared.

But women don’t need to do it alone. In fact, women who approach long-term decisions in partnership with their spouses report soaring levels of satisfaction. Nearly all have high confidence in the future, feel less anxious about money and make fewer financial mistakes.

By sharing decisions jointly, both women and men can face the future with optimism—and set an example of financial partnership for generations to come.

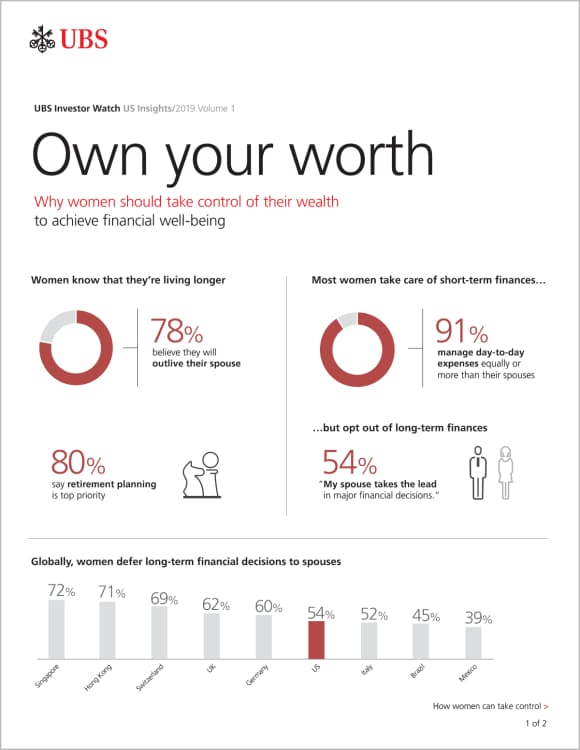

Women know that they’re living longer

Most women take care of short-term finances…

…but opt out of long-term finances

Globally, women defer long-term financial decisions to spouses

Why women opt out

Women who have been there know better

Sharing decisions equally has big benefits

Be involved in your financial future.

Talk to your UBS Financial Advisor.

About the survey

About the survey

From September 2017 to January 2019, UBS surveyed 3,652 women. Of these women, 2,251 were married with at least $1m in investable assets. Others (1,401) were either divorced or widowed. These women had at least $250k in investable assets. UBS also conducted interviews with 71 female respondents. The entire sample was split across nine markets: Brazil, Germany, Hong Kong, Mexico, Singapore, Switzerland, Italy, the UK and the US. The US sample consisted of 797 women (632 married, 165 widowed or divorced).