19 September 2018

Every day, wealthy investors make spending, philanthropic and even career decisions to help make the world a better place.

Every day, wealthy investors make spending, philanthropic and even career decisions to help make the world a better place.

But when it comes to investing, few investors act with the same sense of purpose—yet.

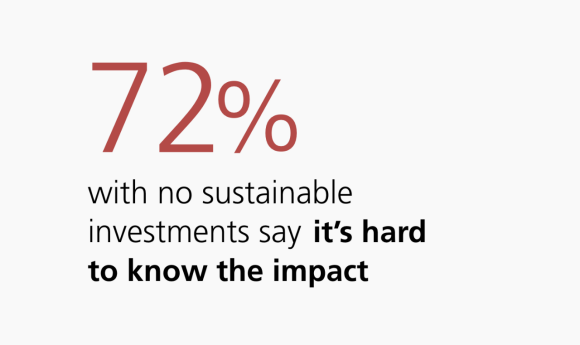

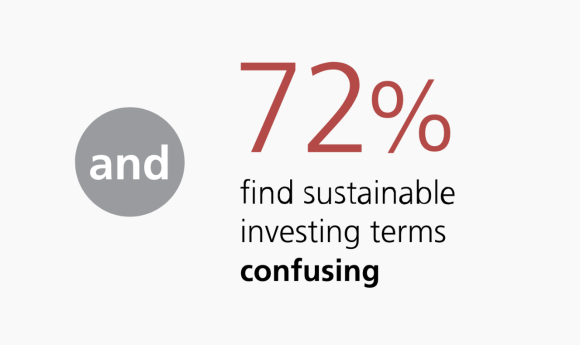

For our latest UBS Investor Watch, we surveyed more than 5,300 investors in 10 markets on sustainable investing. We found that, while some investors understand the basic concept, confusion about sustainable investing terms, its various approaches and even its impact, is widespread. For example, investors make little distinction among the three major sustainable investment approaches: exclusion, integration and impact investing (to make this easier, we included a glossary below).

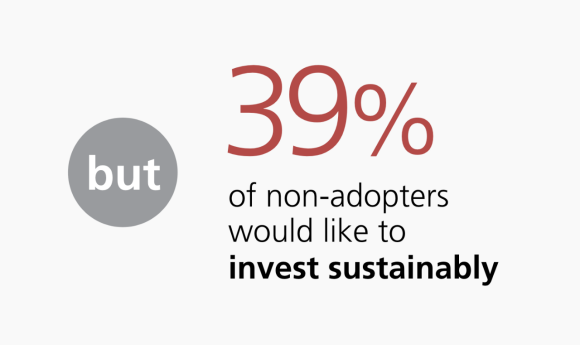

Better education often leads to higher adoption. Sustainable investors, for example, were influenced by multiple sources, including professional advisors, family, friends and media. Nine in 10 cite an advisor’s impact on their decision to invest sustainably.

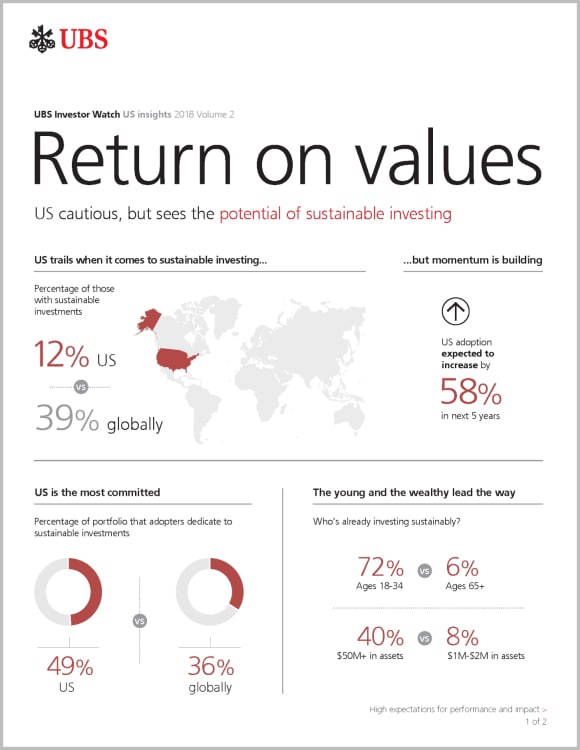

Adoption of sustainable investing varies dramatically across countries. For example, the emerging markets of China and Brazil indicate they have the highest rates of adoption, while only 12% of US investors have any sustainable investments.*

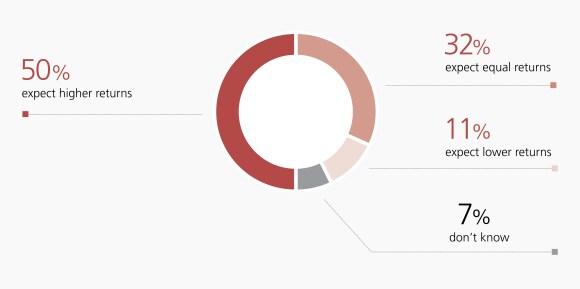

Few investors expect to sacrifice returns when investing sustainably. In fact, 82% believe the returns of sustainable investments will match or surpass those of traditional investments. Investors view sustainable companies as responsible, well-managed and forward-thinking—thus, good investments.

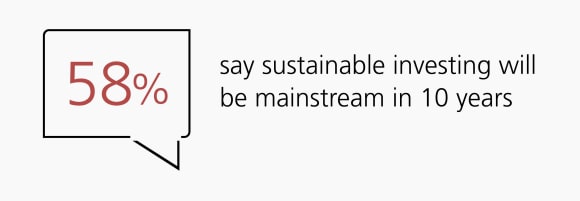

Should investors prove to be right, more companies will likely adopt sustainable practices. Perhaps then, the world will be a better place indeed.

US trails when it comes to sustainable investing...

US trails when it comes to sustainable investing...

...but momentum is building

...but momentum is building

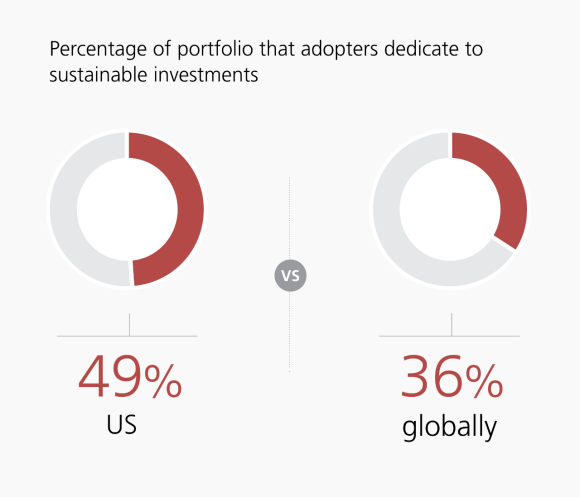

U.S. is the most committed

U.S. is the most committed

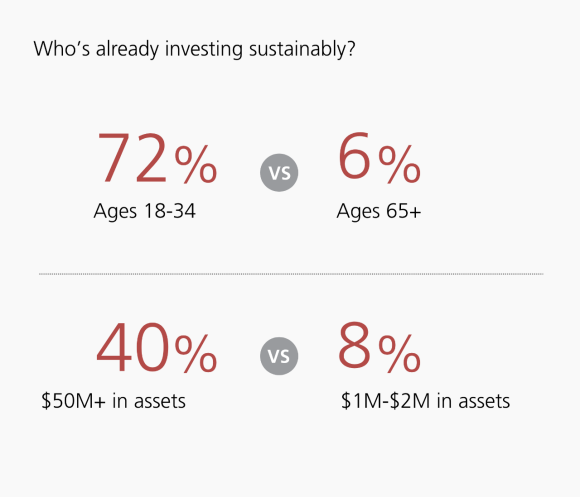

The young and the wealthy lead the way

The young and the wealthy lead the way

Globally, uncertain impact and confusion hold investors back

Globally, uncertain impact and confusion hold investors back

Investors around the world have high return expectations for sustainable investments vs. traditional investments

Investors around the world have high return expectations for sustainable investments vs. traditional investments

Momentum builds for sustainable investing

Momentum builds for sustainable investing

Glossary

Glossary

What is sustainable investing?

Integrates societal concerns, personal values or an institutional mission into investment decisions

Exclusion

Excludes companies or industries from portfolios where they are not aligned with an investor’s values

Integration

Integrates environmental, social and corporate governance (ESG) factors into traditional investment processes, seeking to improve portfolio risk and return

Impact investing

Invests with the intention to generate measurable environmental and social (E&S) impact alongside a financial return

Is your portfolio built to achieve the impact you want? Talk to your UBS Financial Advisor.

About the survey

About the survey

For this edition of UBS Investor Watch, we surveyed more than 5,300 high net worth investors (with at least $1 million in investable assets) across 10 markets: Brazil, China, Germany, Hong Kong, Italy, Singapore, Switzerland, UAE, the UK and the US. The US sample consisted of 1,711 investors, including 472 with at least $5M. The research was conducted between June 2018 and August 2018.

*Adopters of sustainable investments defined as having at least 1% of assets allocated to sustainable investments.