We view sustainability as a comprehensive corporate responsibility, aiming to contribute to the future as a responsible investor today.

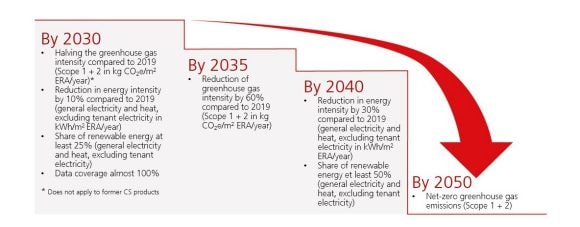

A key part of our strategy is integrating sustainability criteria throughout the entire lifecycle of our properties.

Overview

Publications

Our reporting delivers detailed insights into advancements related to the sustainability of our products and operations.

Real Estate Switzerland issues an extensive sustainability report annually. Furthermore, specific sustainability information pertaining to individual funds is included in the annual reports and sustainability fact sheets of each real estate fund.

Our Real Estate Switzerland team

Daniel Brüllmann

Head Real Estate DACH

Urs Fäs

Head Portfolio Management/ Listed Funds CH

Ulrich Braun

Head Investment Foundations CH

Oliver Müller-Känel

Head International & non-listed Products CH and RE-DA

Matthias Jäger

Head Acquisition & Disposition CH

Christian Braun

Head Market Specialists Real Estate DACH