Sustainable Swiss dividend stocks

High-dividend stocks are attractive even in times of volatility, as dividends make up a substantial portion of the total return on equities.

![]()

header.search.error

High-dividend stocks are attractive even in times of volatility, as dividends make up a substantial portion of the total return on equities.

Swiss companies as a whole are in a sound financial position. Their average net debt based on the ratio between net debt and EBITDA is moderate and has been relatively stable over the last few years. Debt is expected to remain within long-term values this year. In addition, Swiss companies have solid profitability, which is at the upper end of the historical range. Despite the significant price increase on the Swiss equity market over the past decade, the dividend yield has remained stable and attractive. This clearly demonstrates that not only Swiss companies' profits, but also their dividends, were able to grow continuously. It is also important to mention that dividends make up a significant portion of all equity returns based on historical evidence.

Dividends - a large portion of the total return on equities

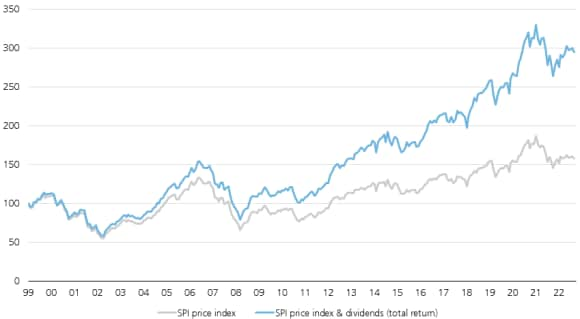

Performance of the SPI without and with dividends from 12/31/1999 to 08/31/2023

Attractive dividend yields in historical comparison

Over the past 23 years, the Swiss Performance Index (SPI) including dividend payments has risen 194%, but only by 57% when excluding dividends. The currently expected dividend yield for the Swiss equity market (SPI) over the next 12 months is 3.2%, well above the 20-year average of 2.4% (as of 21 September 2023).

Defensive characteristics

Dividends have defensive characteristics; their volatility is much lower than that of corporate earnings. During the 2008 global financial crisis, for example, net profits of all companies in the Swiss Market Index (SMI) in Swiss francs declined by 68%, while cumulative dividends fell by only 22%. This is in line with our preference for many companies to provide their shareholders with relatively stable cash returns. Dividends are generally more stable as companies pay only half of their earnings to shareholders on average.

Improved ESG profile

The MSCI Switzerland IMI High Dividend Yield ESG Low Carbon Select Index was created for investors seeking performance of Swiss stocks with high dividend yields while at the same time adhering to specific ESG (Environmental, Social, Governance) criteria. The purpose of an optimization process is to minimize the tracking error versus the standard index, maximize dividend yield and improve the ESG profile: