Your benefits with an investment loan from UBS

You can use investment loans to make strategic investments, improve your investment portfolio and drive the expansion of your company.

Investing in real estate

A UBS Investment Loan is ideal if you want to invest in real estate to optimize your returns and generate cash flow.

Finance expansion

More staff or new production facilities: the expansion of business operations requires additional capital, which can be supplied by an investment loan.

Stay competitive

Whether you want to tap into new markets or modernize your infrastructure: the long-term growth of your company is the key to success.

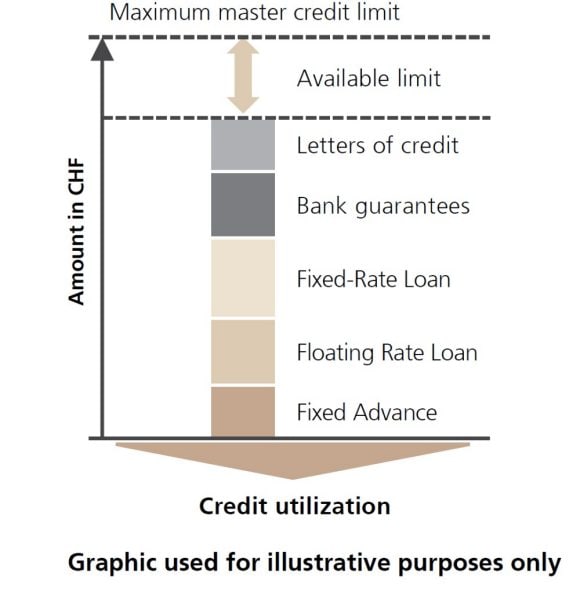

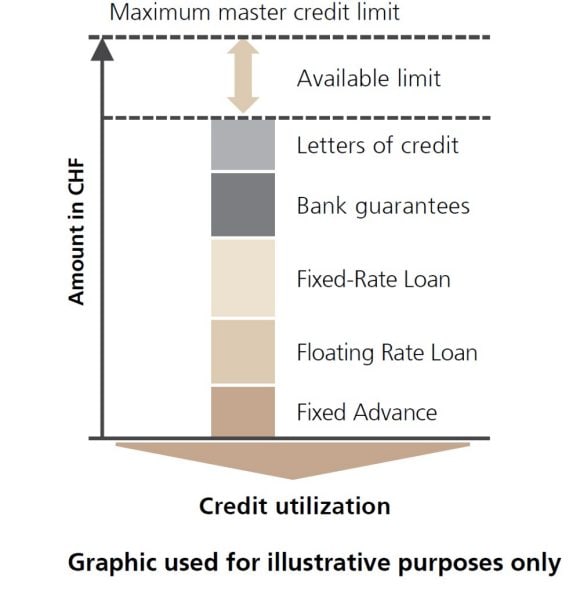

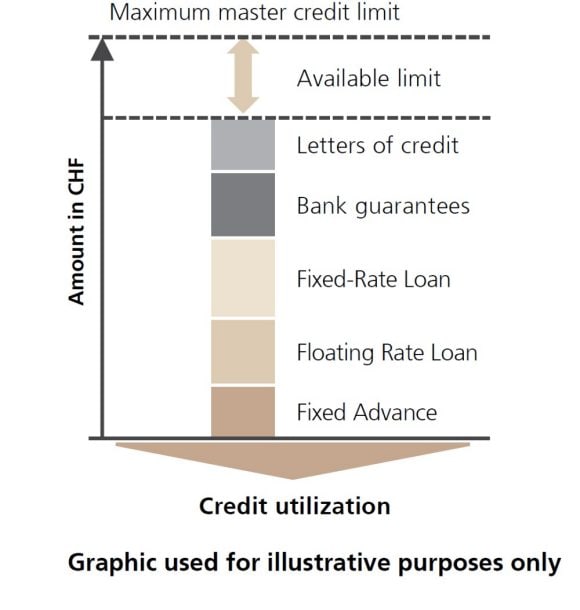

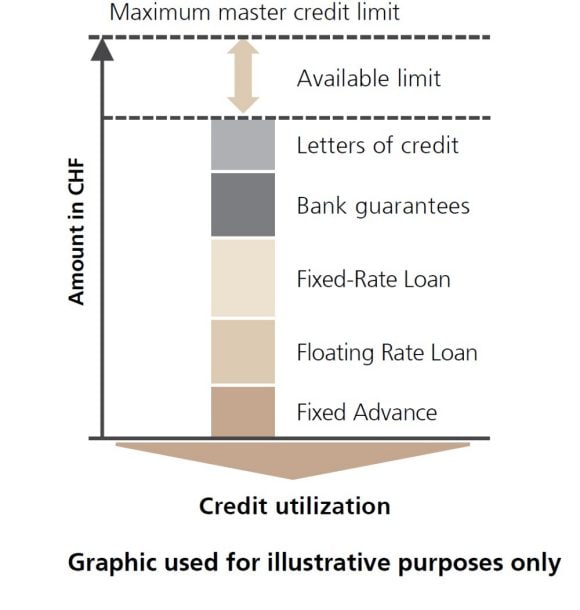

Master credit limit for maximum flexibility

The UBS Corporate Financing master credit limit gives you maximum flexibility to finance your current and fixed assets.