Your benefits at a glance

Protect margins and earnings

Systematically avoid foreign exchange losses.

Plan ahead with confidence

Protect your business from surprises caused by currency fluctuations.

Obtain individual advice

Benefit from our simple, innovative products.

Get expert advice on your personal situation

Currency risks are frequently underestimated by companies. As the world's leading currency company, UBS offers a comprehensive range of currency hedging solutions. I am delighted to put my experience at the service of our clients to develop tailor-made solutions to mitigate the impact of currency fluctuations on their business operations.

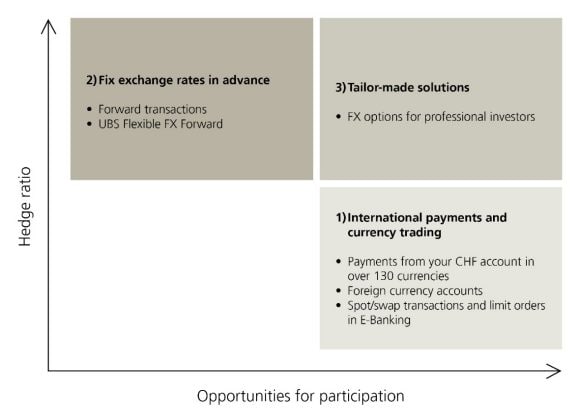

Currency hedging in a nutshell

Our solutions for foreign currency transactions

Especially popular: Flexible FX Forward

Fix the exchange rate in advance for planning certainty and flexibility.

Fix your exchange rate today and get the currency you need when you need it – withdraw the nominal amount or only partial amounts.

How you benefit:

- Fix the exchange rate in advance and enjoy planning certainty

- Withdraw the nominal amount or only partial amounts

- Suitable for buyers or sellers of currencies from CHF 100,000

- No premium payment required

Interested? Arrange a personal consultation online and we will explain the details.

You ask the questions, we have the answers

What our clients say

Also of interest to you

We're here for you when you need us

Make an appointment for a non-binding consultation or call us directly if you have any questions.