Day-to-day

The history of digital banking

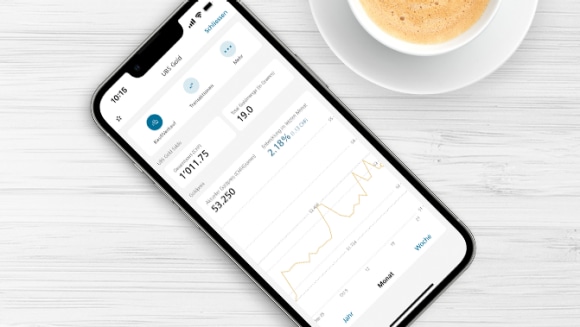

Nowadays we use digital banking anytime and anywhere. But from the original banchi in Italy to the mobile banking app, it has been a long journey. Learn more interesting facts about the history of digital banking.