Invest your wealth

How to invest in private markets

Whether with funds, via managers, with high or low capital investment: supplement your portfolio with private market investments.

![]()

header.search.error

Invest your wealth

Whether with funds, via managers, with high or low capital investment: supplement your portfolio with private market investments.

Principles for your financial involvement in private markets

Investments in private markets provide access to selected and fast-growing markets that are not traded on a public exchange and would otherwise be inaccessible.

Before you consider investing in private markets, you should consider a few fundamentals that apply to these special types of investments.

Find the right balance for your investment. For investors, there is a helpful rule of thumb, which is that to avoid liquidity issue you should hold less than 20 percent of your assets in less liquid investments. If you can access other liquid assets, an investment of up to 40 percent is acceptable. It is important that you carefully weigh up your investment decision within the context of your overall portfolio.

Investing in private markets

Find out more about investing in private markets, the latest market developments and the most interesting opportunities for investors.

If you want to invest in private markets, this is usually done through funds. These are managed by fund specialists called general partners who invest and manage investors’ deposits. You should familiarize yourself with the following processes:

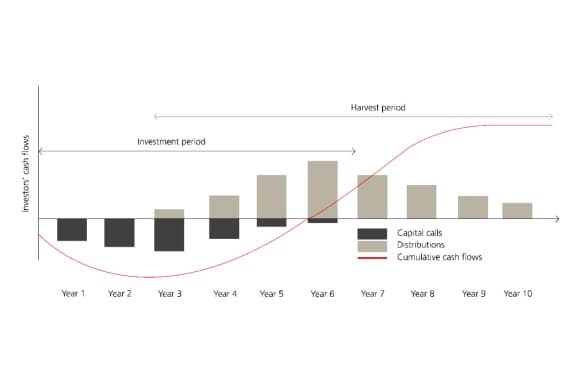

The J-curve: deposits and withdrawals in private market funds

What investment opportunities are available to you in private markets?

The world of private markets opens up various opportunities for you to include assets not available on public exchanges in your overall portfolio. First, you face the decision of which investment approach is right for you. You need to consider the following aspects:

In addition, private market investments can be divided into four different strategies:

Learn more about finance

Would you like to improve your knowledge of alternative investments? Then subscribe to our “Alternative investments” learning path now.

Various investment instruments are available for each strategy:

Open funds: Unlike closed, illiquid private market funds, open funds do not have a fixed term, and shares can be bought and sold at any time. Usually, this happens on a monthly basis. Buyers enter an existing asset portfolio and immediately start participating in potential distributions.

Conclusion

Private markets offer a variety of opportunities for alternative investments, providing suitable investment opportunities for almost every need of wealthy investors. These investments can be an attractive addition to diversify your portfolio but should never be considered in isolation. No matter how promising an investment may sound, it must be harmoniously integrated into your overall investment concept and match your risk strategy.

Because a personal conversation is worth a lot

What can we do for you? We’re happy to address your concerns directly. You can contact us in the following ways: