The route to rebound and recovery - charting China’s comeback

Examining the drivers that will power the economy onto a course of accelerating growth in 2023.

![]()

header.search.error

Examining the drivers that will power the economy onto a course of accelerating growth in 2023.

This year is set to be pivotal for China after its economy grew by just three percent in 2022. A significant rebound is required and a challenging confluence of economic and geopolitical circumstances need to be navigated. Is China on its way?

At the World Economic Forum in January, Beijing reiterated that more focus would be placed on expanding domestic demand, keeping supply chains stable, supporting the private sector, reforming state-owned enterprises, attracting foreign investment, and preventing economic and financial risks. While this serves as a blueprint for growth, it also sends a clear message tailored to reinvigorate investor confidence.

UBS forecasts Chinese GDP to expand by around 5.7 percent in 2023, a rate close to the trajectory of pre-pandemic planned growth. With that in mind, the roles to be played by domestic consumption, innovation and the property sector during the rebound are all under the microscope.

China’s recovery is well underway. From a policy and economic development point of view, it is set to be a year of growth.

Consumption is a key driver of expected growth

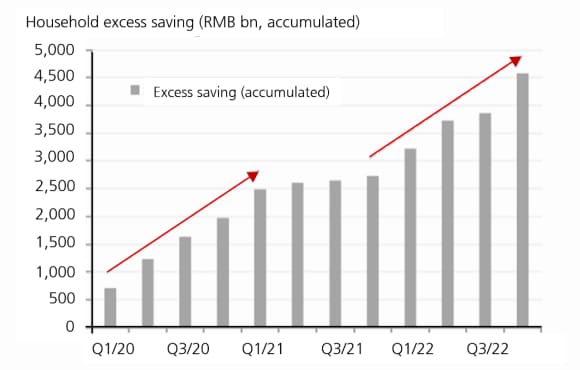

Dr Wang Tao, Head of Asia Economics and Chief China Economist, UBS Investment Bank, believes domestic consumption will be a leading driver of the recovery and grow modestly in 2023. “With the end of the zero-COVID policy (and lifting mobility restrictions), the reopening of SMEs and small shops should create a virtuous circle of gradual employment and income recovery and consumption rebound. Consumption will also be helped by a modest release of some pent-up savings.”

Innovation as a cornerstone

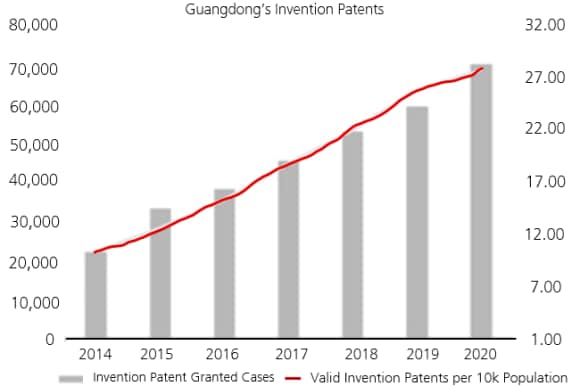

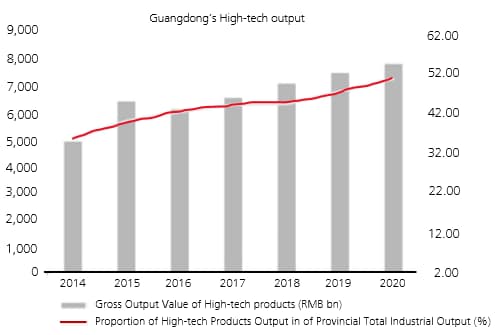

It is widely accepted that innovative activity is the single, most important component of long-term economic growth and China expects innovation to continue to be a key driver of development. It depends, however, on how government pledges of support for the private sector, entrepreneurs and internet platforms translate into real world impact.

According to the National Bureau of Statistics

Furthermore, a UBS report published prior to COVID-19 on innovation in the Greater Bay Area (GBA) showcased that GBA innovators owned more patents (c1.5m) than the Greater Tokyo Bay area, the San Francisco (SF) Bay area and the New York metropolitan areas combined. The majority of patents are related to robotics supply chain solutions in mechanical engineering, physics and electricity.

You can read more about what’s powering innovation in China heremore about innovation in china

Property - slowly stablizing

Many investors will also be paying close attention to China’s property sector this year - UBS estimates its negative contribution amounted to more than three percentage points of GDP growth in 2022.

While not expected to be a major engine of growth this year, UBS expects any negative impact the property sector has on GDP expansion to be ‘marginal’, with UBS forecasting sales to stabilize in Q1 and rebound sequentially as mortgage rates fall and affordability improves.

James Wang, Head of China Strategy, UBS believes the steps taken by the government to address risk have already had a positive impact. “No one is talking about systemic risk anymore, and this represents a significant change in investor psyche.”

Capital raising has returned for quality issuers in selective sectors

As the Chinese economy revives its growth trajectory, capital raising activities have been constructive, both on and offshore. Year to date in 2023, according to UBS bankers:

“We expect the market to continue to gradually reopen this year for China issuers in selective sectors,” explains Mandy Zhu, Head of China Global Banking at UBS. “Global investors, especially European and Asia Pacific investors, have returned to China’s capital markets as witnessed by the recent deals, and we hope there will be strong onshore ECM financing demand driven by more market oriented pricing and review mechanisms.”

China’s economy remains resilient and broad based.

Summing up the rebound story, Tommie Fang, Head of China Global Markets, UBS explains that “growth is a central focus of the Chinese government - we know this from our dialogue with the regulators and it was reiterated at our GCC 2023. China’s economy remains resilient and broad based, and although not without its challenges as with all other global economies. We see a positive recovery in 2023 is underway, with multiple opportunities for investors and corporates looking for capital formation. We see long term value for both domestic China and international organizations.”