HOLT

HOLT: Understanding Intangibles Impact on Investment Analysis

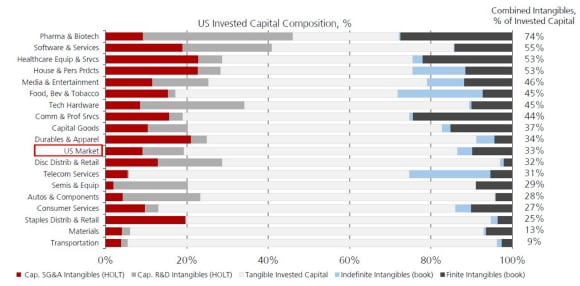

A steady rise in the knowledge-based economy has changed how companies invest, making the quantification of intangible capital more important for investors.