UBS Virtual Museum

1965-1998

1965

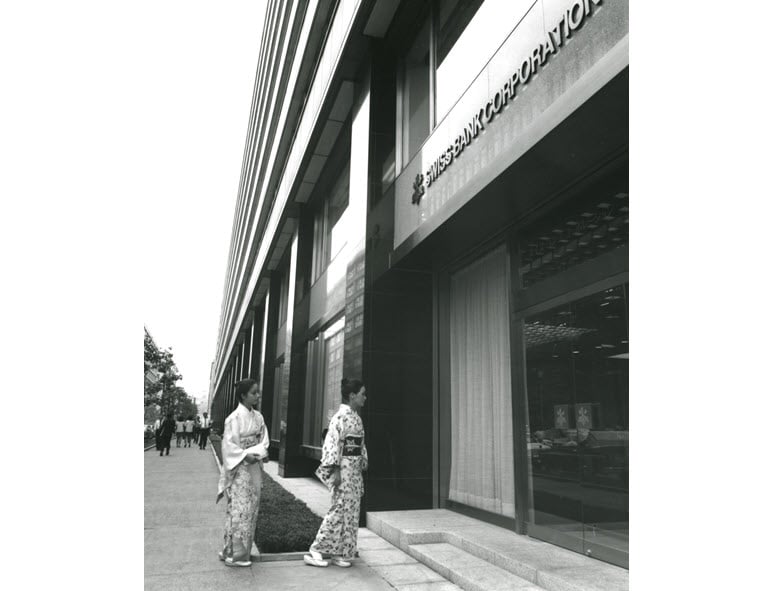

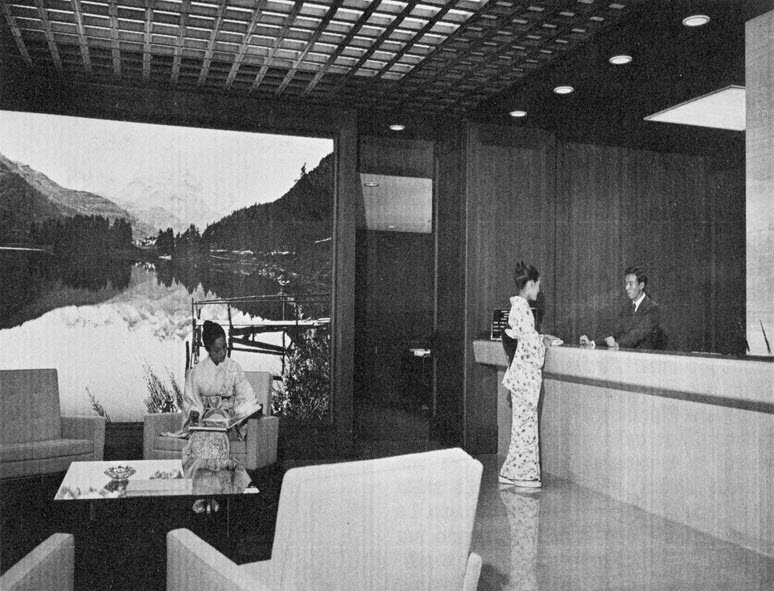

SBC starts its business in Tokyo – followed by Union Bank of Switzerland a year later

Swiss Bank Corporation (SBC) opened an office in Tokyo’s Marunouchi business district in 1965, after recognizing in the early 1960s the future potential of Japan’s economic growth and the growing trade with the country. This provided Japanese business clients and foreign ventures in East Asia with the services of a commercial bank. However, retail banking and securities trading were prohibited by Japanese banking law. The start of investment banking operations by Union Bank of Switzerland and SBC in 1966 would be supporting Japan’s economic growth in the 1970s and 1980s.

1967

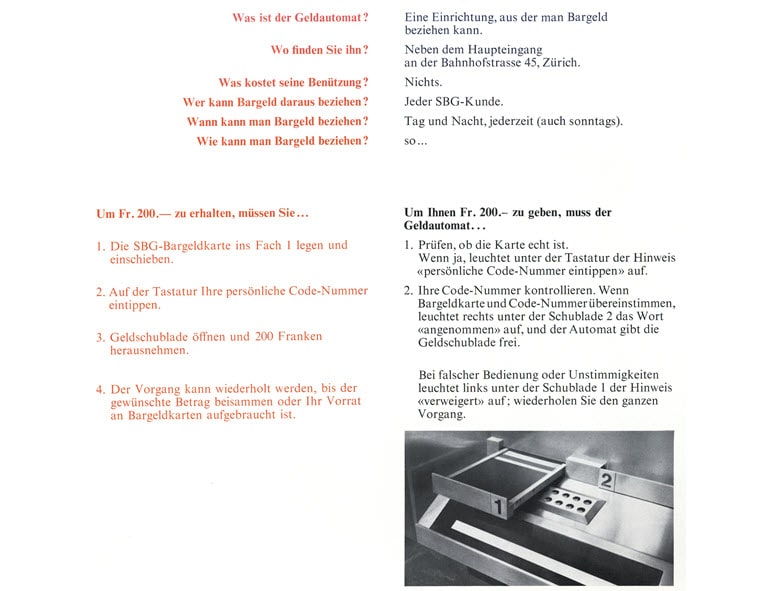

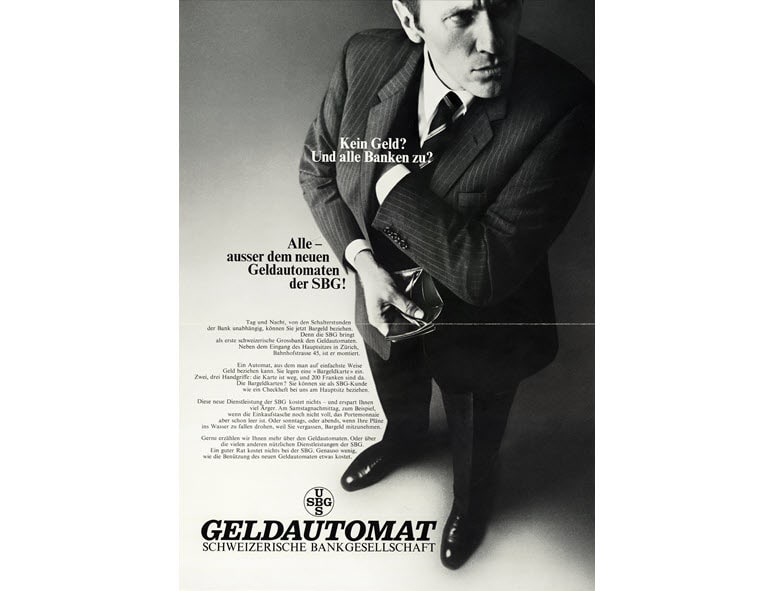

The first cash dispenser

The move from drive-in banking to cash dispenser withdrawals was a logical one. However, the automation needed for this required a number of preparatory steps. The first generation of cash dispensers required the user to withdraw reference checks of CHF 200 each in advance. Those checks made it possible to withdraw money whenever needed. Union Bank of Switzerland was the first bank in Switzerland to introduce a cash dispenser. A year later came the Bancomat, a unified cash dispenser system by the Swiss banks. 23 such machines were operational at the beginning of 1969.

1969

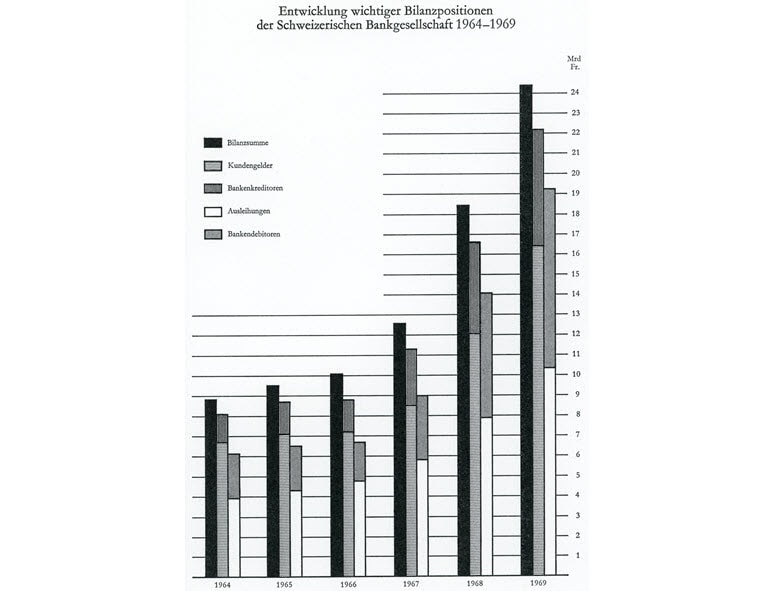

Rapid balance sheet growth

The 1950s and 1960s were exceptionally good for Union Bank of Switzerland. Buoyed by its successful takeover of the Eidgenössische Bank in 1945, which had propelled Union Bank of Switzerland into the ranks of Switzerland’s major banks, the firm entered a period of rapid growth. Aided by increasing automation, the strong growth of the global economy and the surge in population and prosperity in Switzerland, these two decades were marked by a significant expansion of the branch network through the opening of new branches and a number of bank takeovers, especially in Switzerland. In its 100th anniversary year (1962), Union Bank of Switzerland topped the rankings for the first time, as the biggest bank in Switzerland, with total assets of CHF 6,961 million. This was equivalent to almost doubling in five years. Through its merger with Interhandel AG in 1967, Union Bank of Switzerland became one of the most highly capitalized financial institutions at European level.

1972

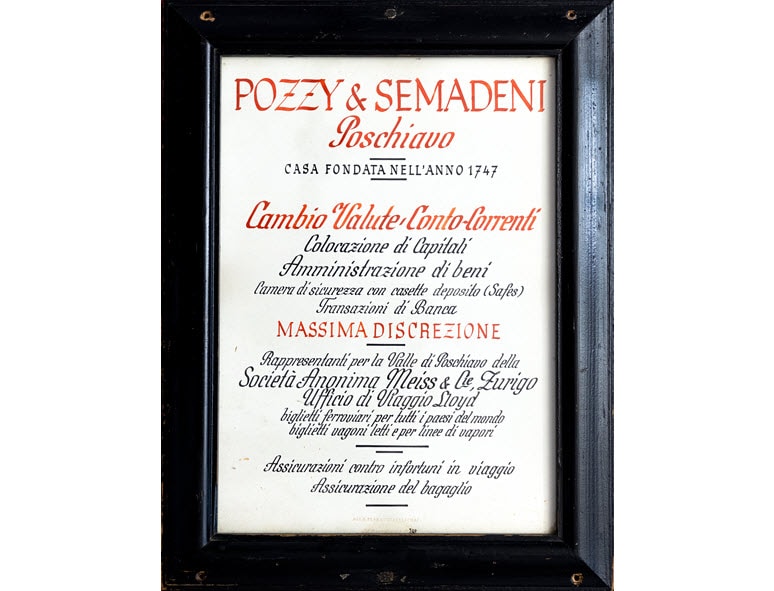

UBS takes over Pozzy Bank

In addition to opening a new branch in Switzerland’s Puschlav valley, Union Bank of Switzerland acquired the banking division of the Pozzy trading company in 1972. Pozzy Bank was founded in 1747, making it the oldest of all the banks acquired by UBS to date. Pozzy Bank is still the oldest of the 370 or so UBS predecessor institutions: none of the banks acquired by Swiss Bank Corporation were established even remotely as early as Pozzy Bank. UBS maintained operations of the Poschiavo branch until 2021.

1975

Union Bank of Switzerland opens the Wolfsberg Training Center

In 1970, Union Bank of Switzerland bought Wolfsberg Castle, built in 1576 and perched on cliffs above Ermatingen, including around 12 hectares of land, with the idea of establishing a training center there. The contract to refurbish the castle and build the training center was awarded to the Zurich architectural firm of Rudolf and Esther Guyer. The older buildings, which were renovated in close cooperation with the department responsible for the preservation of historic monuments, include the castle, Parquin House, a castle chapel and stables. These buildings housed the guest rooms, dining and recreation areas, staff quarters, and offices. The new school wing consists of classrooms, a lecture hall and an auditorium. Three residential buildings with 120 single rooms and a sports facility were also newly built.

1976

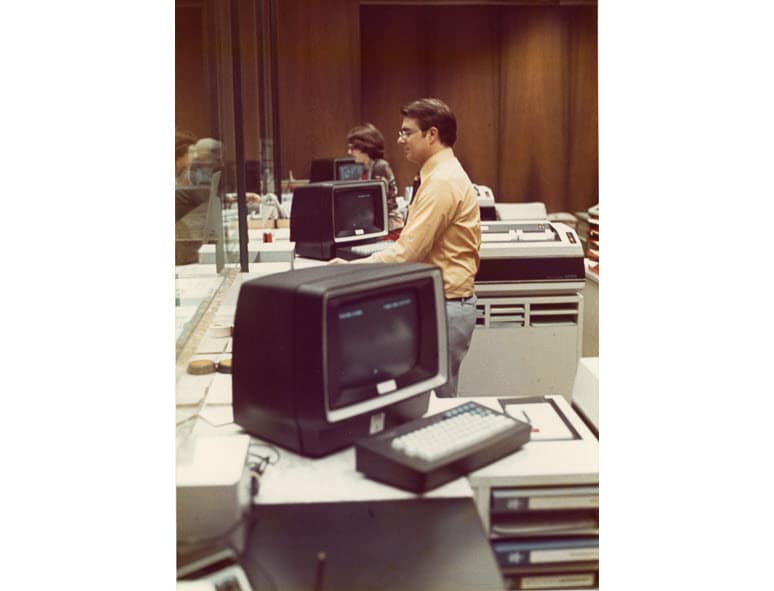

Real-time banking

In the late 1970s, Swiss Bank Corporation created a revolution in digitalization. Swiss Bank Corporation was the first Swiss bank to enter the era of real-time banking. This innovative step linked almost all of the computers within the bank together into a single network, accelerated the exchange of data and, little by little, automated a range of work processes across all banking areas. The improvement in efficiency, while simultaneously improving quality, was enormous. Tasks that, up to then, had usually been done manually, in time-consuming and labor-intensive steps, were now dealt with by real-time banking in just a few seconds.

1989

A mascot for the littlest savers

Any child who opened an account with Swiss Bank Corporation received a money box and also, from 1989 onward, a cuddly toy: a little turquoise fox. Since then, the bank’s mascot has taught thousands of children all about saving and about managing their money. After Swiss Bank Corporation and Union Bank of Switzerland merged in 1998 to form UBS, the little fox’s fur color was changed to red, and he was given the name Topsy and a group of friends to go on adventures with, friends known in English as Sophie Squirrel, Barry Badger and Willie Woodpecker. Topsy and his pals have since appeared as computer animations, coloring-in pictures, and gadgets in communication media, and they’ve also appeared live at a range of events for children.

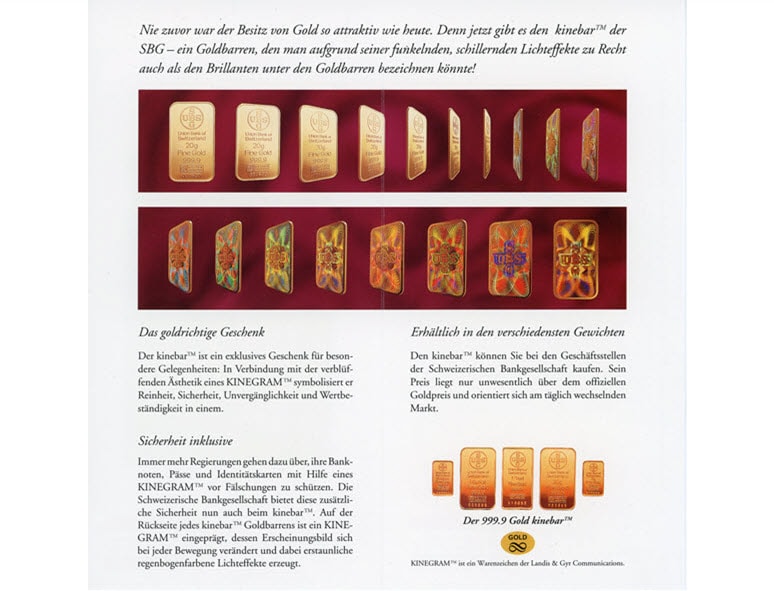

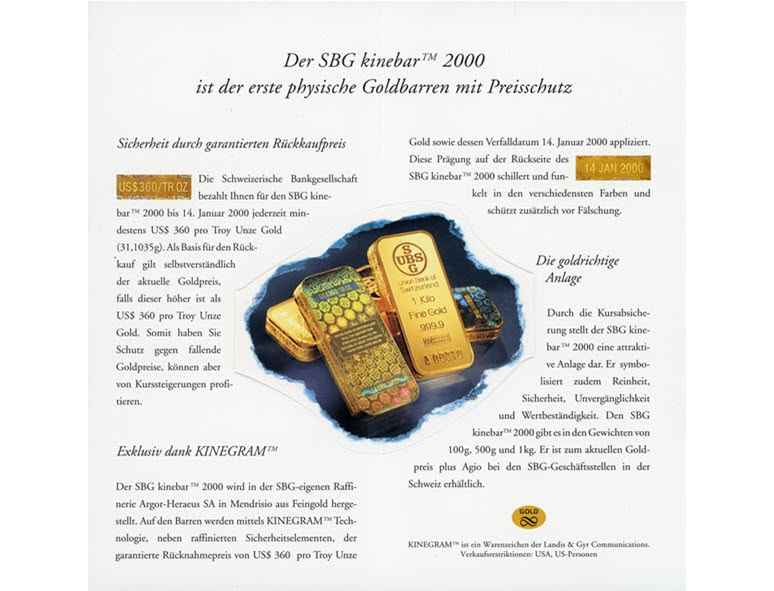

1993

The Union Bank of Switzerland Kinebar – a glittering jewel

Ordinary gold bars gleam dazzlingly. But the gold bars issued by Union Bank of Switzerland aren’t ordinary: they’re counterfeit-protected Kinebars. Kinebars are minted using what’s known as Kinegram technology, in which a computer-generated image is applied to the reverse of the bar. Depending on how the light falls, an iridescent rainbow of colors in every hue seems to shimmer within the image. This world-first innovation at Union Bank of Switzerland was announced to the press on 2 December 1993. When they were launched, the Kinebars were offered in 5 gram, 20 gram and one ounce sizes.

1994

Swiss Bank Corporation embarks on a partnership with Art Basel

The success story that has become the largest and most important art fair in the world has its origins in Basel. It was here that in 1970 three local gallery owners turned their idea of an international art fair into reality. The trio selected 271 galleries that met their high-quality criteria, just one in three of the applicants. This meant the standard of the exhibits was exceptional, and both the number of visitors and the sales figures grew steadily each year. The high quality of Art Basel, its international flavor and its ability to consistently adapt to new movements has made the fair a resounding success and in 1994 brought it a partnership with Swiss Bank Corporation as the main sponsor. Eight years into this partnership, Art Basel expanded to Miami Beach, where it was soon attracting tens of thousands of collectors to each session. And in 2013, Art Basel's expansion continued in Hong Kong, where it is now the leading art fair in the Asia-Pacific region.

1998

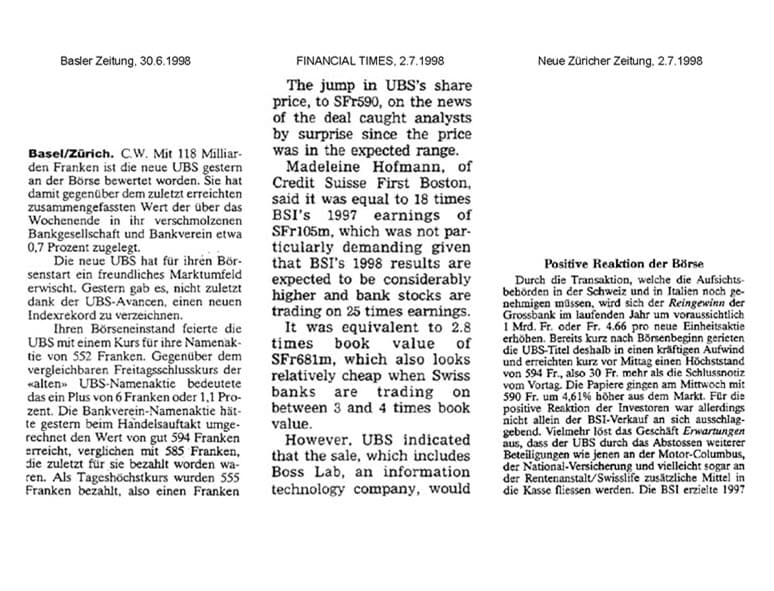

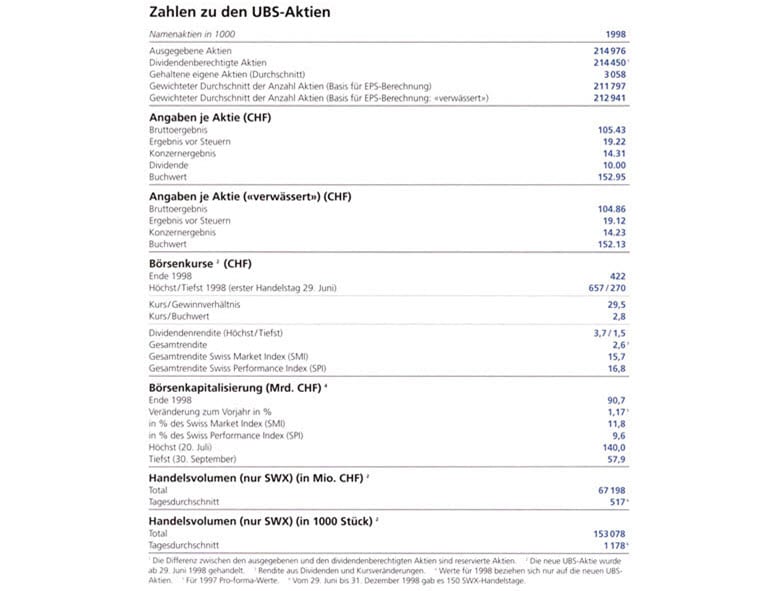

Union Bank of Switzerland and Swiss Bank Corporation merge to form UBS

On the morning of 8 December 1997, Switzerland woke up to a news story that was remarkable and made headlines around the world: the two major Swiss banks, Union Bank of Switzerland and Swiss Bank Corporation, had announced that they were merging. The name of the new Swiss universal bank was UBS. As the press release said, the merger paved the way for the creation of one of the world’s leading financial services firms. UBS would go on to occupy a globally top-ranking position in its three core areas of business: private banking, institutional asset management and investment banking. With its leading position in the market for private and corporate clients in Switzerland, UBS had a very solid foundation on which to build further international expansion.