SNB initiates interest rate turnaround

Economy expected to brighten in the second half of 2024

![]()

header.search.error

Economy expected to brighten in the second half of 2024

While 2022 saw the Swiss economy grow at an above-average rate of 2.7% thanks to the recovery potential unlocked by the pandemic, growth in 2023 was significantly lower at 0.8%. This was due in particular to a slowdown in industry, caused in part by the weak economy in other European countries. The unemployment rate rose to 2.4% in May 2024, a figure that can still be considered low even in comparison to the lowest rate of 1.9% in spring 2023. Despite below-average economic growth, overall employment nevertheless grew by 70,400 full-time equivalents in 2023. Growth in the first quarter of 2024 was moderate but remained positive, with the creation of an extra 2,800 jobs. Thanks to the solid employment situation, private consumption was stable in 2023 and boosted the services segment of the Swiss economy in particular. The results of the Purchasing Managers' Index (PMI) clearly demonstrate that the economy continues to be divided into two parts: While the PMI for industry has been below the growth threshold of 50 points at 46.4 points for five quarters now, the PMI for the services sector is more robust. That said, it has also been more volatile recently, having changed by more than five points in the last three months. Although the services indicator shows a nervous sideways trend, the services sector is likely to bolster the economy slightly. As a result, the Swiss economy is expected to grow by 1.3% in 2024 and 1.5% in 2025.

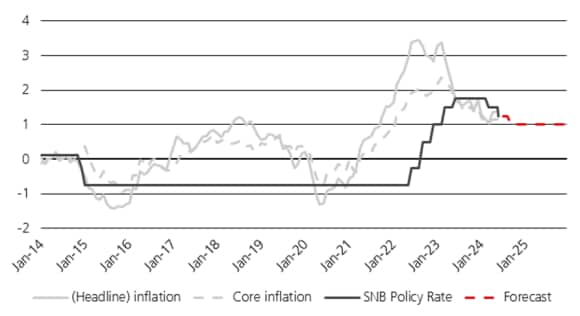

Inflation dynamics have declined significantly compared to their peak in summer 2022. Annual inflation was still 2.1% on average in 2023, but from June it returned to within the Swiss National Bank's (SNB) target range of 0%–2%. Since February 2024, the inflation of domestic goods prices has also been below the 2% threshold. In view of the decline in inflation, the SNB initiated an interest rate turnaround in March 2024, lowering the key interest rate from 1.75% to 1.5%. Following an additional interest rate cut of 25 basis points in June, the key interest rate now stands at 1.25%. A further interest rate cut of 25 basis points is currently expected for the remainder of 2024.

Inflation, core inflation, and SNB key interest rate

Higher risk premiums leading to greater market momentum

Before the change of direction that has now taken place, the 250 basis point interest rate rise between September 2022 and June 2023 significantly changed the environment for real estate investments. Prime yields on the real estate market have now adapted to the new conditions. For residential and office properties, the initial return in the prime segment increased by 65 basis points and 70 basis points respectively in the first quarter of 2024 compared to the minimum in the second quarter of 2022. The Prime yield on retail space, which had a much more moderate dynamic in the years before the interest rate turnaround, rose by 50 basis points. The return on ten-year government bonds fell significantly again, putting the risk premium for real back to around 155 basis points estate in the first quarter of 2024, just below the average of 170 basis points seen over the past 25 years.

As risk premiums rise, momentum on the transaction market is also likely to pick up again. This had formally come to a standstill over the past two years owing to a "disagreement" between buyers and sellers over what constitutes a reasonable price level. In the residential segment, which is being buoyed by sharply rising demand on the rental market, the correction in yields has recently slowed significantly and indicates a bottoming out. Although valuations are lagging behind slightly, this in combination with the interest rate reversal initiated and the waning denominator effects should help the transaction market to gain momentum.

Strong growth in demand driving up asking rents

Demand on the Swiss rental housing market is continuing to rise sharply. With net immigration of 98,900 people, the figure for 2023 was only slightly below the record figure seen in 2008. The figure was over 28,000 in the first four months of 2024 alone. Yet the expansion of supply remains on the decline: At just under 32,700 residential units, the total number of building permits issued in 2023 was around a third below the long-term average. With 9,300 permits issued in the first quarter, the start of 2024 suggests that this trend is not reversing. The vacancy rate is continuing to fall as a result, which in turn is driving up asking rents. In the first quarter of 2024, asking rents across Switzerland rose by 6.3% year-on-year. Regions such as Zurich with exceptionally high demand recorded double-digit rent increases. Existing rents have also increased due to two 25 basis point steps in the mortgage reference interest rate in June and December 2023, taking the rate to 1.75%. The reference interest rate for mortgages is based on the average of all mortgage interest rates in Switzerland. If the rate increases, owners of residential properties can adjust rents. A further increase in the reference interest rate is currently no longer expected. Due to persistently strong household growth and record-low construction activity, however, a vacancy rate of less than 1% is expected in 2024. This means that asking rents should continue to record strong growth. The increasing scarcity of supply and high rent increases are likely to lead to a further increase in the number of political campaigns and initiatives aimed at regulating the rental housing market in the medium term. While around 30% of Swiss rental housing stock is currently subject to some kind of regional regulation (e.g. rent at cost, right of pre-emption, rent brake), the entry into force of all currently planned additional measures could increase this proportion to just under 50%.1 However, this is likely to further reduce the incentives to build new residential dwellings, thereby exacerbating the lack of housing.

Rent price growth

(% in comparison with the previous year)

Differentiation in commercial real estate

While the rental housing market is characterized by shortages more or less nationwide, the situation for commercial real estate varies greatly depending on the location and quality of the properties. This is due both to the current slowdown in the economy and to structural change processes. The demand for office space has changed significantly over the past four years in view of home working and hybrid working models. However, Swiss companies have a significantly higher office presence than other countries and the effects of the economic slowdown due to the stability of the labor market have been contained. As a result, the supply ratio rose only marginally from 4.5% to 4.6% between 2022 and 2023. Nevertheless, as in other markets, there is evident differentiation between locations in favor of prime properties also in Switzerland. Generally speaking, less space is needed per employee, but the quality requirements for the space in question are higher. As companies need to remain attractive to employees – especially at a time when there is a shortage of skilled workers – accessible, modern, sustainable spaces are in demand. By contrast, it is becoming increasingly difficult to negotiate a lease for secondary properties, which is reflected in the rents: While the very highest rents (for top properties in prime locations in Zurich and Geneva) in the office sector rose by 5.9% year on year in the first quarter of 2024, average rents fell by 3.1%.

A similar picture can be seen on the market for retail space: Despite consumer sentiment currently being poor and retail sales declining, retail space in central, well-frequented locations continues to record solid demand on the rental market as well as rental growth. The popularity of prime locations is growing due to several factors, among them the return of tourists: The 41.8 million overnight stays in 2023 not only signifies further recovery from the pandemic-induced slump, but actually constitutes a new record.

Positive rental prospects sustaining real estate value

The rise in interest rates led to corrections on the real estate markets in 2023, and Switzerland was no exception. Compared to many foreign real estate markets, however, the value adjustments across all segments in Switzerland were moderate at -1.7% due to the lower interest rate rise and solid user market fundamentals. The latter supported the residential segment in particular: While residential real estate values fell by 0.9% in 2023, the correction in the office segment (-2.6%) and the retail segment (-2.5%) was almost three times as steep.

The focus on user market data that characterizes the Swiss valuation system – compared with systems that are strongly geared toward the transaction market – means that although value adjustments are more moderate than those in foreign countries, they are also likely to be slightly more drawn-out. The corrections should therefore continue in 2024, particularly in the commercial segment, where minor depreciation of 1.8% on average for office space and 1% for retail space is anticipated. By contrast, the very positive prospects for rent increases on the housing market are likely to return the performance of residential real estate to positive territory in 2024, with almost neutral appreciation of +0.4% expected. In general, capital value growth like at the time of negative interest rates, which were associated with strong pressure to invest, are no longer to be expected. Consequently, cashflow returns and therefore active asset management – particularly taking sustainability factors into account – are becoming a clear priority.

This does not constitute a guarantee on the part of UBS Asset Management.

Head Real Estate DACH

Head Portfolio Management/ Listed Funds CH

Head Investment Foundations CH

Head International & non-listed Products CH and RE-DA

Head Acquisition & Disposition CH

Head Market Specialists Real Estate DACH