1962

First staff restaurants at both banks

In Switzerland, nearly one in eight people now eats in a communal catering establishment once a day. Staff restaurants have had a significant impact on lunch-break eating habits. Large industrial companies started providing canteens for their employees in the 1920s as shift working was more widely introduced, and in the 1960s, with continuous working hours becoming the norm, more and more large service companies also began to offer staff catering. Within a few years, the short meal break in the staff restaurant had replaced the two-hour lunch break at home.

1965

The first TV commercial

For the first ten years of its existence Swiss television was commercial-free. On 1 February 1965, the first commercial break was shown. Union Bank of Switzerland was among the first companies to use the advertising medium, along with Pepsi, Ovomaltine and Opel even though there had initially been a debate at the bank over using TV advertising. The TV commercial was intended by some of the bank’s marketing experts to demonstrate its progressiveness, but detractors were worried that the new medium wouldn’t be appropriate for “the position and reputation of a large bank.” SBC aired its first TV commercial in 1967.

1965

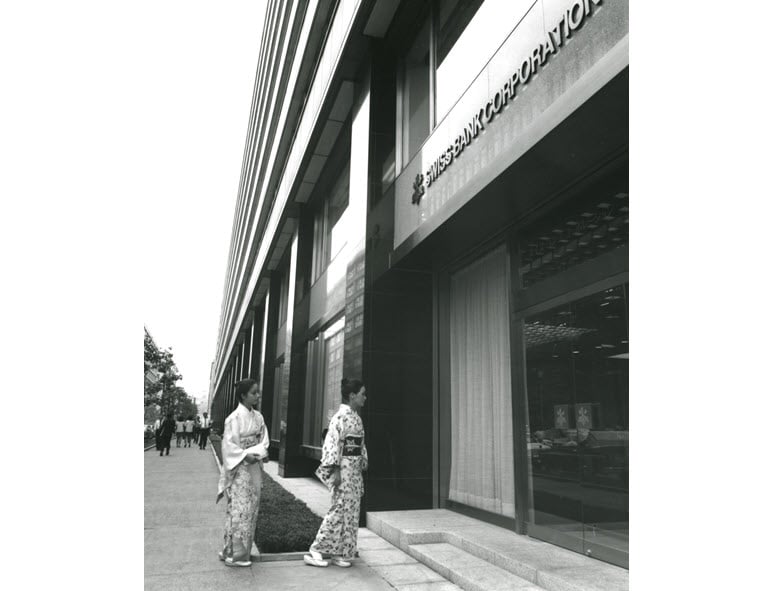

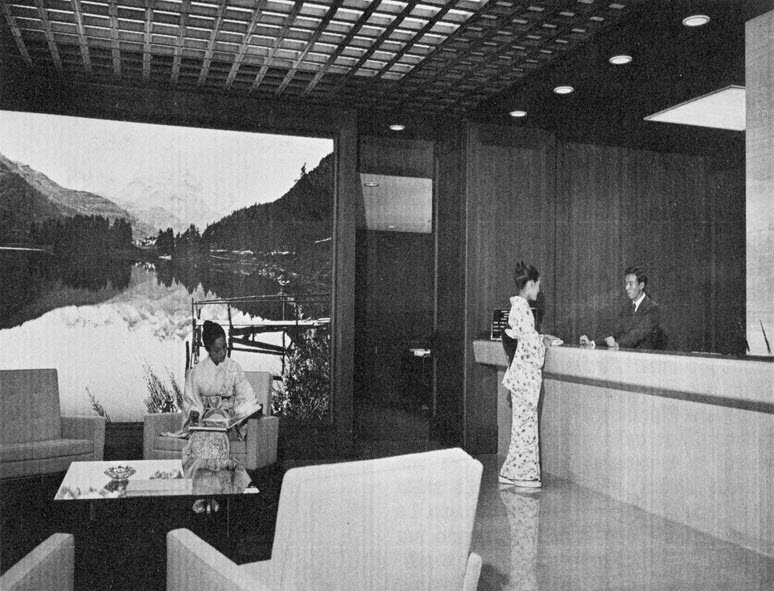

SBC starts its business in Tokyo – followed by Union Bank of Switzerland a year later

Swiss Bank Corporation (SBC) opened an office in Tokyo’s Marunouchi business district in 1965, after recognizing in the early 1960s the future potential of Japan’s economic growth and the growing trade with the country. This provided Japanese business clients and foreign ventures in East Asia with the services of a commercial bank. However, retail banking and securities trading were prohibited by Japanese banking law. The start of investment banking operations by Union Bank of Switzerland and SBC in 1966 would be supporting Japan’s economic growth in the 1970s and 1980s.

1967

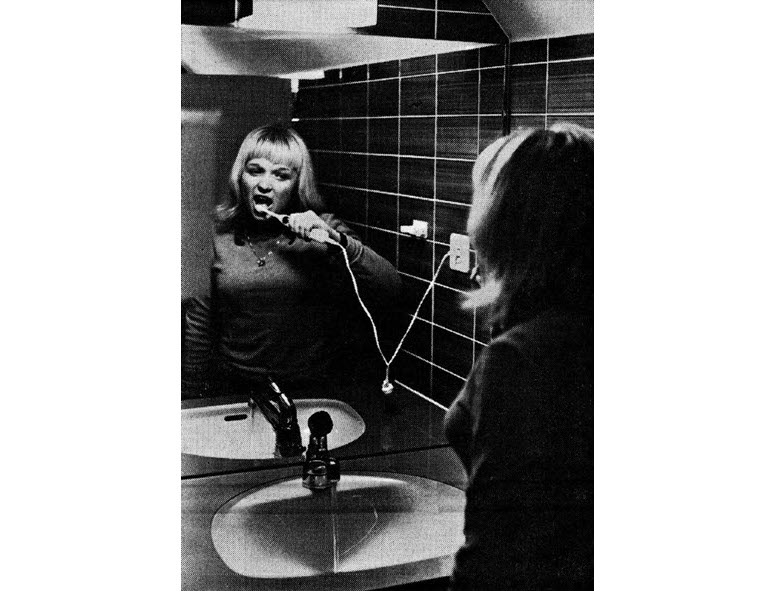

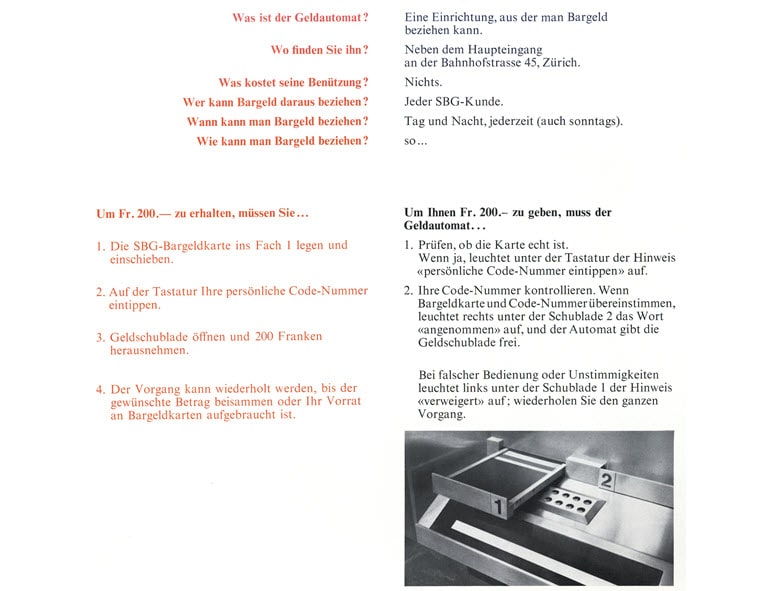

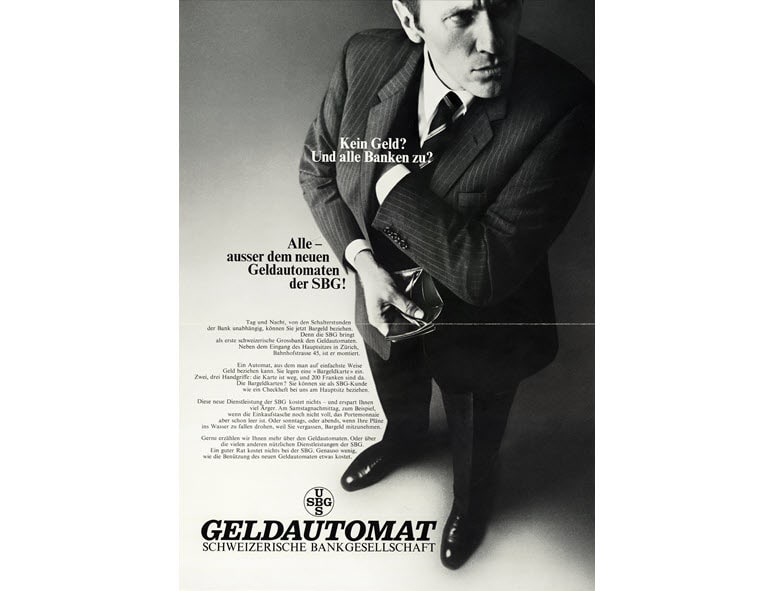

The first cash dispenser

The move from drive-in banking to cash dispenser withdrawals was a logical one. However, the automation needed for this required a number of preparatory steps. The first generation of cash dispensers required the user to withdraw reference checks of CHF 200 each in advance. Those checks made it possible to withdraw money whenever needed. Union Bank of Switzerland was the first bank in Switzerland to introduce a cash dispenser. A year later came the Bancomat, a unified cash dispenser system by the Swiss banks. 23 such machines were operational at the beginning of 1969.

1969

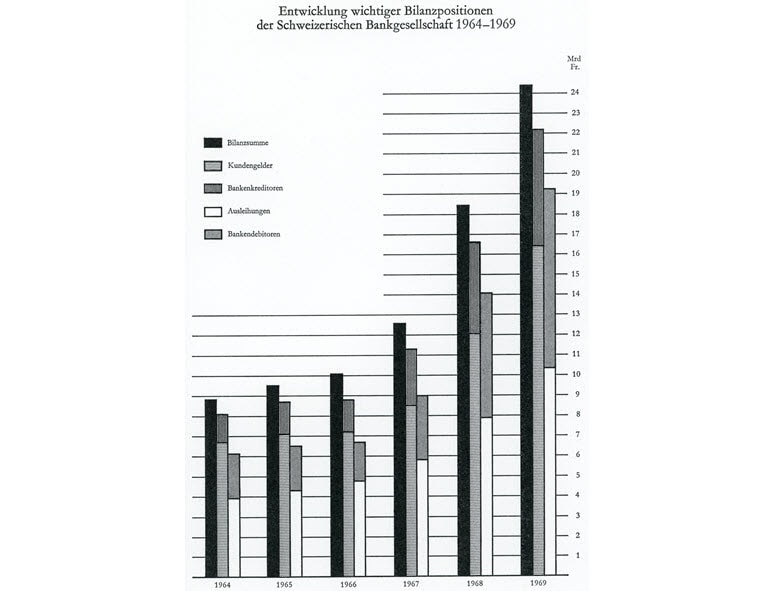

Rapid balance sheet growth

The 1950s and 1960s were exceptionally good for Union Bank of Switzerland. Buoyed by its successful takeover of the Eidgenössische Bank in 1945, which had propelled Union Bank of Switzerland into the ranks of Switzerland’s major banks, the firm entered a period of rapid growth. Aided by increasing automation, the strong growth of the global economy and the surge in population and prosperity in Switzerland, these two decades were marked by a significant expansion of the branch network through the opening of new branches and a number of bank takeovers, especially in Switzerland. In its 100th anniversary year (1962), Union Bank of Switzerland topped the rankings for the first time, as the biggest bank in Switzerland, with total assets of CHF 6,961 million. This was equivalent to almost doubling in five years. Through its merger with Interhandel AG in 1967, Union Bank of Switzerland became one of the most highly capitalized financial institutions at European level.

1972

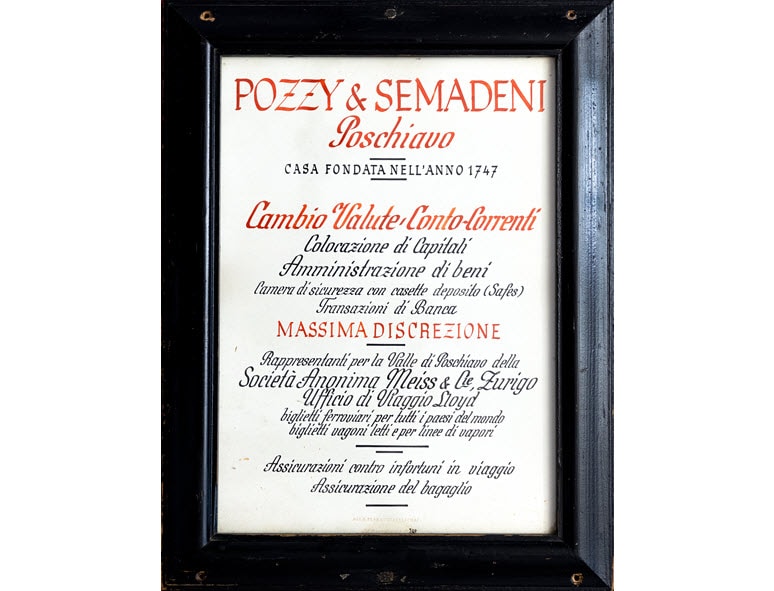

UBS takes over Pozzy Bank

In addition to opening a new branch in Switzerland’s Puschlav valley, Union Bank of Switzerland acquired the banking division of the Pozzy trading company in 1972. Pozzy Bank was founded in 1747, making it the oldest of all the banks acquired by UBS to date. Pozzy Bank is still the oldest of the 370 or so UBS predecessor institutions: none of the banks acquired by Swiss Bank Corporation were established even remotely as early as Pozzy Bank. UBS maintained operations of the Poschiavo branch until 2021.

1975

Union Bank of Switzerland opens the Wolfsberg Training Center

In 1970, Union Bank of Switzerland bought Wolfsberg Castle, built in 1576 and perched on cliffs above Ermatingen, including around 12 hectares of land, with the idea of establishing a training center there. The contract to refurbish the castle and build the training center was awarded to the Zurich architectural firm of Rudolf and Esther Guyer. The older buildings, which were renovated in close cooperation with the department responsible for the preservation of historic monuments, include the castle, Parquin House, a castle chapel and stables. These buildings housed the guest rooms, dining and recreation areas, staff quarters, and offices. The new school wing consists of classrooms, a lecture hall and an auditorium. Three residential buildings with 120 single rooms and a sports facility were also newly built.

1976

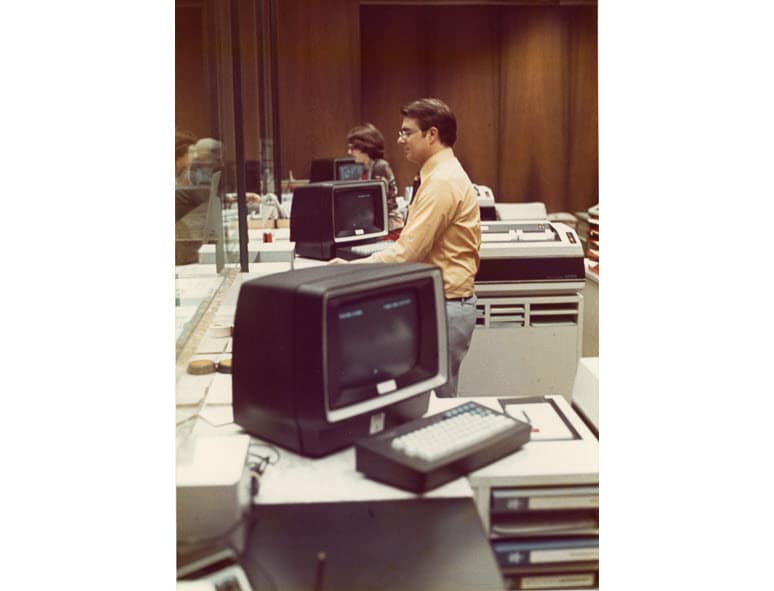

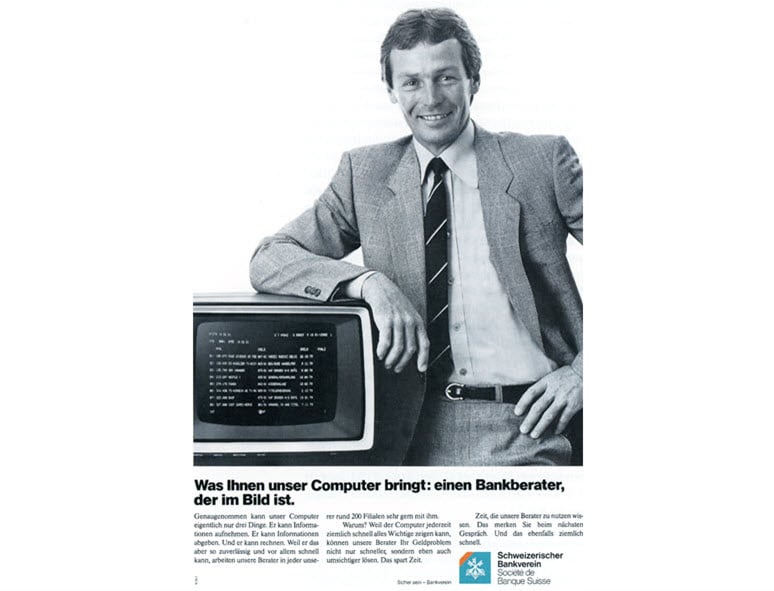

Real-time banking

In the late 1970s, Swiss Bank Corporation created a revolution in digitalization. Swiss Bank Corporation was the first Swiss bank to enter the era of real-time banking. This innovative step linked almost all of the computers within the bank together into a single network, accelerated the exchange of data and, little by little, automated a range of work processes across all banking areas. The improvement in efficiency, while simultaneously improving quality, was enormous. Tasks that, up to then, had usually been done manually, in time-consuming and labor-intensive steps, were now dealt with by real-time banking in just a few seconds.

1976

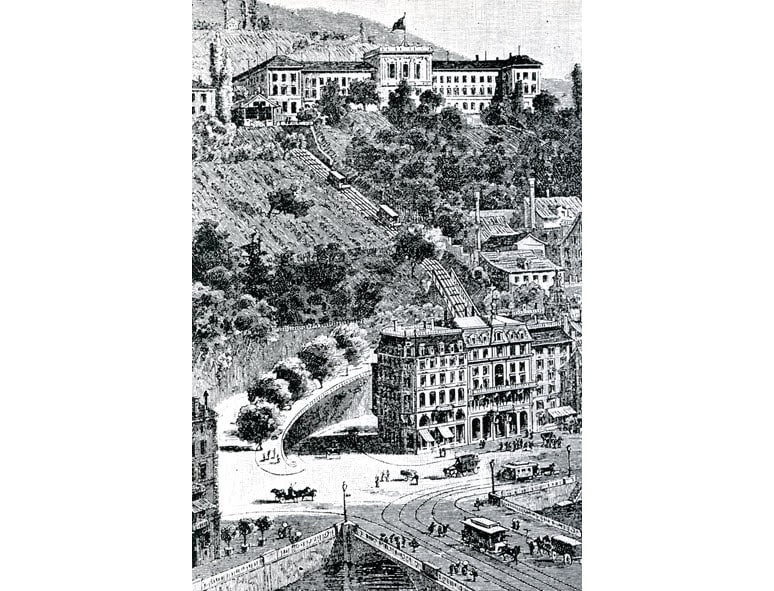

Union Bank of Switzerland rescues Zurich's Polybahn funicular

Ever since the Polybahn funicular first opened in 1889, its bright red carriages have transported thousands of passengers up and down the hill between central Zurich and the city's two universities every day. But despite its popularity, changing transport trends meant that passenger numbers and proceeds had fallen so low by the early 1970s that the owners increasingly found themselves in the red. In 1975 they slammed on the brakes and refused to carry out an expensive refurbishment required to renew their license. Instead, they started looking for a buyer - to no avail. Just as the Polybahn's fate seemed sealed - and the owners had taken the first steps to close it down - the Union Bank of Switzerland stepped in. It took over the Polybahn, renovated it and adapted it to comply with stricter safety standards. Six months later, Zurich celebrated the return of the Polybähnli (as it's affectionately known among locals) with a big party.

Find out more at Polybahn

1989

A mascot for the littlest savers

Any child who opened an account with Swiss Bank Corporation received a money box and also, from 1989 onward, a cuddly toy: a little turquoise fox. Since then, the bank’s mascot has taught thousands of children all about saving and about managing their money. After Swiss Bank Corporation and Union Bank of Switzerland merged in 1998 to form UBS, the little fox’s fur color was changed to red, and he was given the name Topsy and a group of friends to go on adventures with, friends known in English as Sophie Squirrel, Barry Badger and Willie Woodpecker. Topsy and his pals have since appeared as computer animations, coloring-in pictures, and gadgets in communication media, and they’ve also appeared live at a range of events for children.