1993

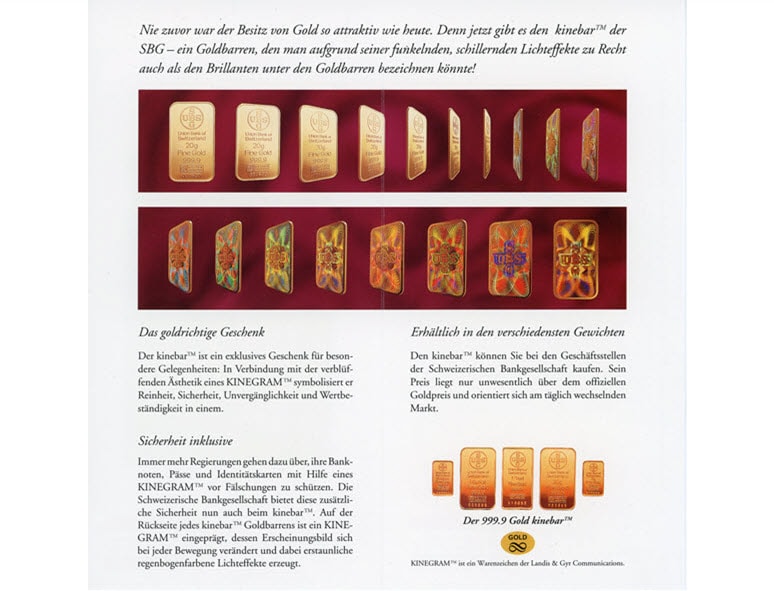

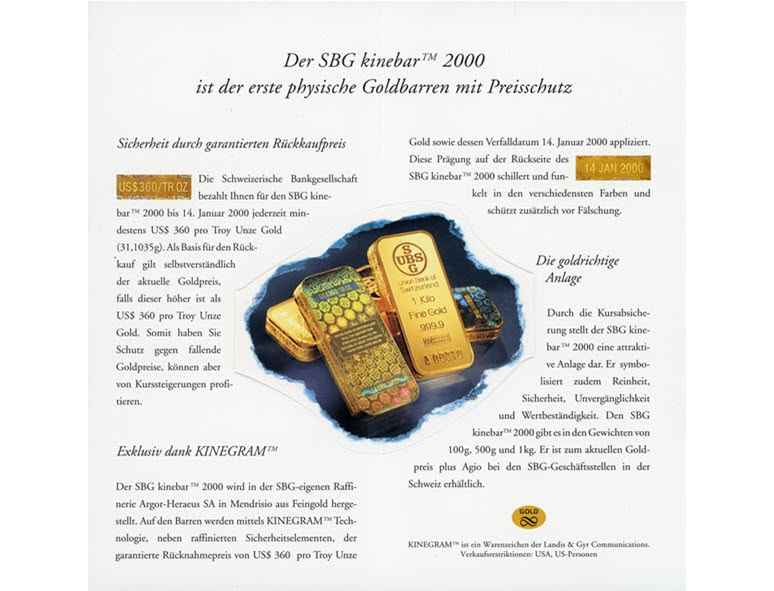

The Union Bank of Switzerland Kinebar – a glittering jewel

Ordinary gold bars gleam dazzlingly. But the gold bars issued by Union Bank of Switzerland aren’t ordinary: they’re counterfeit-protected Kinebars. Kinebars are minted using what’s known as Kinegram technology, in which a computer-generated image is applied to the reverse of the bar. Depending on how the light falls, an iridescent rainbow of colors in every hue seems to shimmer within the image. This world-first innovation at Union Bank of Switzerland was announced to the press on 2 December 1993. When they were launched, the Kinebars were offered in 5 gram, 20 gram and one ounce sizes.

1994

Swiss Bank Corporation embarks on a partnership with Art Basel

The success story that has become the largest and most important art fair in the world has its origins in Basel. It was here that in 1970 three local gallery owners turned their idea of an international art fair into reality. The trio selected 271 galleries that met their high-quality criteria, just one in three of the applicants. This meant the standard of the exhibits was exceptional, and both the number of visitors and the sales figures grew steadily each year. The high quality of Art Basel, its international flavor and its ability to consistently adapt to new movements has made the fair a resounding success and in 1994 brought it a partnership with Swiss Bank Corporation as the main sponsor. Eight years into this partnership, Art Basel expanded to Miami Beach, where it was soon attracting tens of thousands of collectors to each session. And in 2013, Art Basel's expansion continued in Hong Kong, where it is now the leading art fair in the Asia-Pacific region.

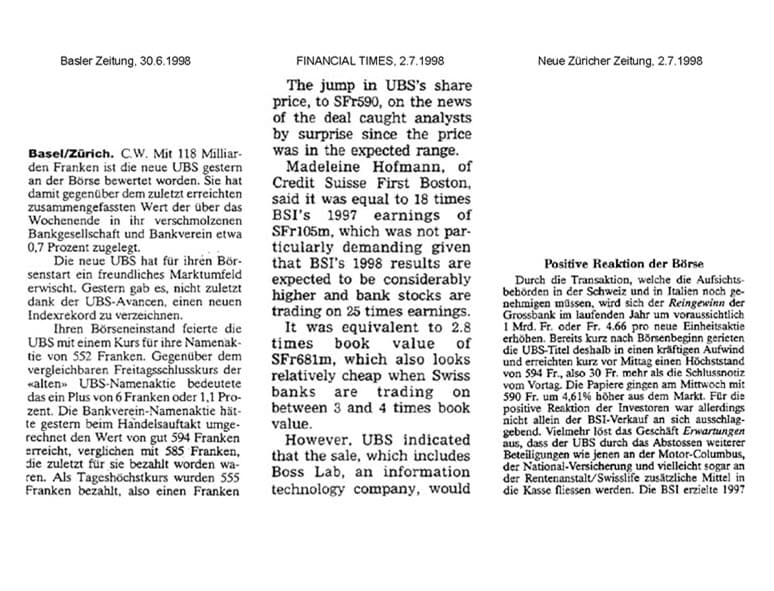

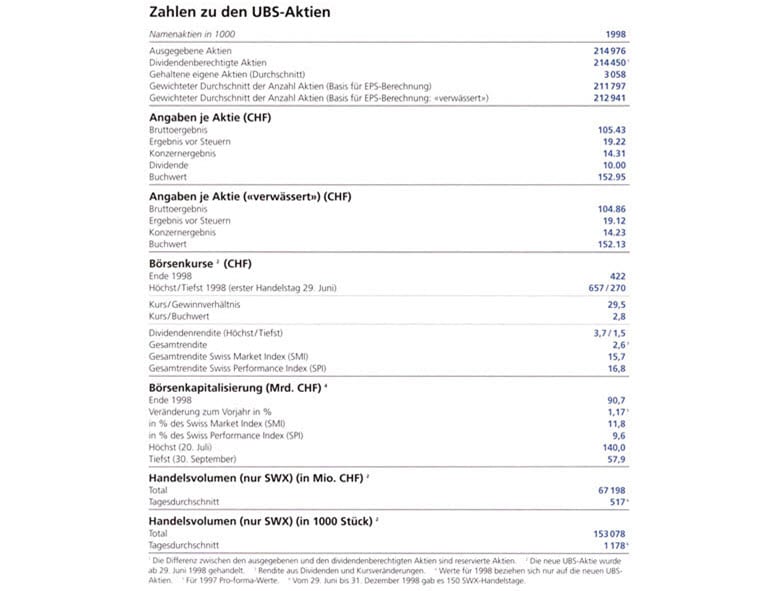

1998

Union Bank of Switzerland and Swiss Bank Corporation merge to form UBS

On the morning of 8 December 1997, Switzerland woke up to a news story that was remarkable and made headlines around the world: the two major Swiss banks, Union Bank of Switzerland and Swiss Bank Corporation, had announced that they were merging. The name of the new Swiss universal bank was UBS. As the press release said, the merger paved the way for the creation of one of the world’s leading financial services firms. UBS would go on to occupy a globally top-ranking position in its three core areas of business: private banking, institutional asset management and investment banking. With its leading position in the market for private and corporate clients in Switzerland, UBS had a very solid foundation on which to build further international expansion.

2000

The young UBS is listed on the New York Stock Exchange

The integration costs arising from the merger, and the setback due to the collapse of the large Long-Term Capital Management hedge fund, resulted in a disappointing first financial year. However, by the end of 1999 the wind was already changing to a more positive direction, and UBS was able to look to the future with optimism. In 2000, UBS announced stable financial results for the first time. And on 16 May 2000, UBS had its global registered shares listed on the New York Stock Exchange, which paved the way, two months later, for the merger with the long-established US asset management company PaineWebber Group Inc.

2000

UBS takes over US asset manager PaineWebber

On 12 July 2000, UBS and the US’s fourth-largest asset management company, PaineWebber Group Inc., announced that they would be merging at the end of November. Because the two firms operated in complementary areas of business, the alliance was equally attractive to both parties. Firstly, taking over PaineWebber would open the door to the US investment market for UBS, and, secondly, it made UBS the world’s leading asset manager: in 1999 UBS was managing customer assets worth CHF 1,744 billion, while the assets managed by the American firm totaled CHF 794 billion. In return for their shares, Paine Webber shareholders could choose between cash and UBS shares, which were reissued for this deal and were quoted on the Swiss Stock Exchange on 3 November 2000. Following its integration in 2003, the UBS PaineWebber division was renamed UBS Wealth Management USA.

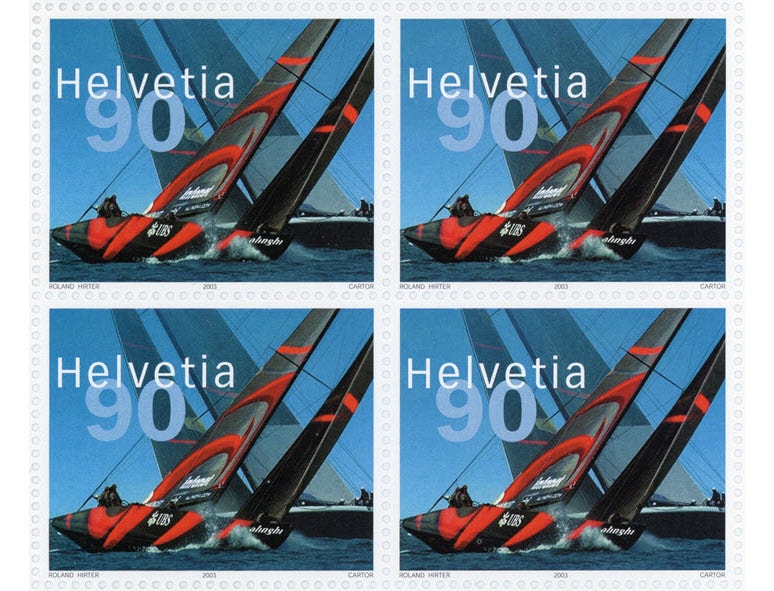

2003

Alinghi team wins the 31st America’s Cup with UBS sponsorship

Sunday 2 March 2003 saw an absolutely sensational event: not only did a sailing team from the Old Continent bring the America’s Cup to Europe for the first time in the 162-year history of the oldest trophy in international sport. Even more remarkably, the winning team came from the landlocked nation of Switzerland and achieved victory the first time it entered the race. This was the Alinghi team, founded in 1994 by Geneva-based entrepreneur, Ernesto Bertarelli. In 2001, UBS signed an exclusive sponsorship deal with Alinghi, and just two years later the Alinghi–UBS partnership entered the history books. In 2007, it repeated its success in Valencia, Spain, claiming the 32nd America’s Cup as its own and bringing the coveted ”Auld Mug” home.

2007

UBS gets sucked into the global financial crisis

In the years following the takeover of PaineWebber, UBS rapidly strengthened its position on the world's biggest financial market and in emerging economies. In 2006, the Group achieved the best results in its history, but the boom would come to an abrupt end in the summer of 2007. After nine successful years, in October 2007 the firm suffered a pre-tax loss of CHF 726 million. The trigger was a drastic real estate crisis in the US, resulting in a deteriorating situation on the sub-prime mortgage market. UBS’s structured investment products, which were based on this kind of real estate loan, were particularly badly hit. In total, UBS had to write off about CHF 50 billion – its entire equity. Trading difficulties were also increasing at other financial institutions. On 15 September 2008, the US investment bank Lehman Brothers filed for insolvency. The collapse of this long-established bank triggered a domino effect.

2008

Saving UBS

On 16 October 2008, UBS reached an agreement with the Swiss government and the Swiss National Bank that enabled it significantly to reduce the risks on its balance sheet. As part of the solution, a fund would be set up by the Swiss National Bank to buy up illiquid securities held by UBS to the value of up to USD 60 billion, to reduce the pressure on UBS’s balance sheet. During 2007 and 2008, UBS succeeded in raising, in a number of stages, capital amounting to CHF 42.5 billion and so was able to keep its core capital ratio at between 10% and 12%. The main cause of the huge losses was the involvement by the Investment Bank, spurred on by ambitious growth targets, in US mortgage-backed securities and asset-backed securities.

2011

UBS launches the UBS Kids Cup, the most successful program for young talent in Swiss sport

In the 2022 season, the Swiss stars of athletics shone more brightly at international championships than ever before. UBS had laid the foundations for their unprecedented success on the medal table eleven years earlier, when, together with Swiss Athletics and the organizers of Weltklasse Zürich, it inaugurated the UBS Kids Cup, a program to encourage people all over Switzerland to get more exercise. Since the launch of this series of events, in which boys and girls compete in the disciplines of 60 m sprint, long jump and ball throwing, around 1.5 million children and young people have taken part. Many of them were spotted there as promising new talents and were supported from then on until they joined the ranks of potential medal winners. Click here to find out more about the program for young talent.

2011

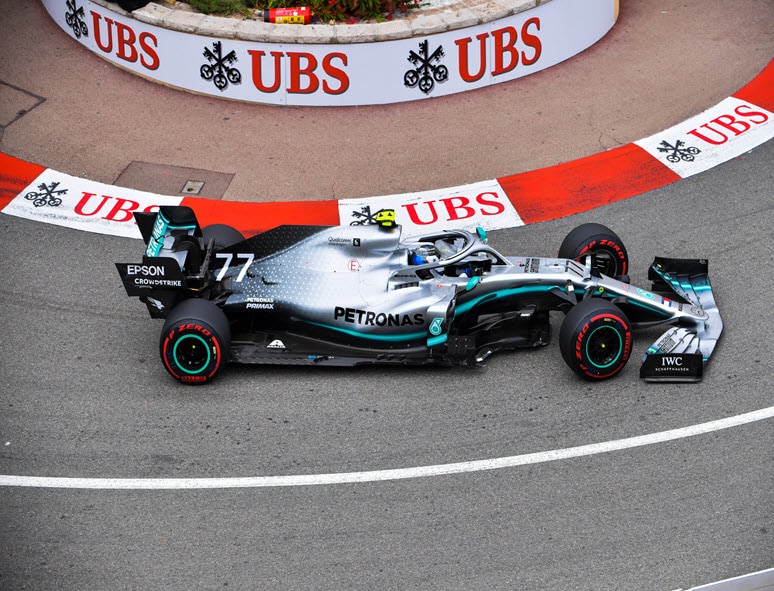

2011 UBS embarks on Formula One sponsorship

Following its recovery after the financial crisis and the resulting far-reaching culture change, UBS wanted to reposition itself with sponsorship deals that demonstrated its renewed confidence. During the 2010 Grand Prix season, UBS decided to make a careful start by becoming a global sponsor for Formula One motor racing. One year later, UBS committed itself to top-flight motorsport, giving it a global brand presence at all races. In addition to boosting brand recognition and enhancing its image in growth regions, UBS also benefited from the media presence, from a high-profile platform for offering hospitality and from an increase in new business.