We're here for you when you need us

Make an appointment for a non-binding consultation or call us directly if you have questions.

Change in the law

Imputed rental value is to be abolished. Disagreement over whether it should also be scrapped for second homes and over the future amount of the debt interest that can be deducted is delaying a change in the law.

Content:

Switzerland is one of the few countries where owners pay tax on the apartments or houses they occupy. Although the abolition of the imputed rental value tax has been discussed for decades, all attempts at change have so far failed.

We show you how taxation of imputed rental value works, how the burden could be reduced and what a reform might look like.

Imputed rental value is the notional rent that an owner would receive if they rented out their own home and counts as taxable income. The value is ultimately determined by the cantonal tax authority but, according to the Federal Court, must be at least 60 percent of the average market-level rent. Otherwise, each canton is free to calculate imputed rental value as it sees fit.

The current system generates high tax revenues for the federal government, cantons and municipalities but the calculation, adjustment and implementation of this tax all require a great deal of administration.

To compensate for the tax on imputed rental value, mortgage interest and maintenance costs are tax-deductible. With respect to maintenance costs, property owners across all cantons can choose each year whether to claim the effective costs or a lump-sum amount. In most cantons, this amount is between 10 and 20 percent of the imputed rental value, depending on the age of the property.

Who is subject to imputed rental value taxation?

Anyone who owns a house or apartment which they live in themselves must pay tax on the imputed rental value of the property. They do not have to live in the property all the time but it must be permanently available to them.

This means that imputed rental value is also taxed on second homes and vacation homes used by the owner. The tax is also due if relatives live in the house or apartment free of charge.

The idea behind the taxation of imputed rental value: Although owners do not receive monetary payment from their owner-occupied property, they do receive a cash-equivalent benefit. After all, tenants also have to pay rent, and if owners rent out their house or apartment, the rental income is likewise subject to income tax.

The intention behind taxing imputed rental value is to create tax fairness between the different groups.

Owners can deduct costs that are directly related to the property from the imputed rental value, which significantly reduces their effective tax burden.

The influence of interest rates

The impact on taxes for private households, but also on the federal government, cantons and municipalities, is largely dependent on interest rate levels. While mortgage rates are low, the deductions for many homeowners are lower than the tax on the imputed rental value. A change of system would be very welcome for them.

Only with significantly higher mortgage rates of 3 or 3.5 percent would the deduction for mortgage interest roughly offset the tax on imputed rental value. In this case, a change of system would make no difference for many owners in terms of taxation.

Although many have advocated for a change to the taxation of imputed rental value, all attempts at reform have so far failed (as of September 2024). Two main points of contention have emerged:

Firstly, the cantons with tourist regions and a high number of second homes do not want to give up the considerable income they receive from taxing the imputed rental value of vacation properties. Accordingly, the Council of States only wants to agree to the abolition of the tax on primary residences, whereas the National Assembly is in favor of a complete system change – and therefore also the abolition of the tax on second homes. According to the National Assembly, the cantons affected should be given the opportunity to compensate for the loss of revenue by means of a “property tax on second homes.” In September 2024, the National Assembly reaffirmed the general system change.

Secondly, there is disagreement on the deductibility of debt interest. Currently, owners can deduct interest on debt to the extent of their taxable assets and a further CHF 50,000 per year – a sum that is rarely reached in practice.

The Council of States is in favor of allowing debt interest of up to 70 percent of taxable property income to be offset against tax in future. In contrast, the National Assembly has so far voted for 40 percent. In September 2024, the National Assembly deviated from this line when a narrow majority voted in favor of applying the proportionate-restrictive method, under which the amount of the debt interest deduction is based on the ratio of immovable assets (excluding owner-occupied residential property) to total assets.

Key points of the discussion

Who the winners of abolition would be …

Changing the system would be of most benefit to those homeowners who have almost repaid their mortgage and who do not invest heavily in the maintenance of their home and therefore cannot claim large deductions.

Pensioners in particular would benefit because although their incomes almost always fall after retirement, the taxable imputed rental value of their property remains the same. The impact of taxation of imputed rental value in relation to income is then higher. For families with children and working parents, on the other hand, the tax relief would be much lower.

The age of the real estate also has tax implications: while there will not be much to deduct for maintenance and renovation costs in the case of new properties, owners usually have to invest large sums years or decades later. Renovations and maintenance can significantly reduce income taxes, provided the system that allows deductions for property maintenance is retained.

… and who would be the losers

Buyers of older properties will likely be at a disadvantage. Those who buy an older house and invest heavily in renovations will no longer qualify for substantial tax relief on these expenses Both the construction industry and economists expect fewer incentives for property maintenance. A likely consequence is that the price gap between new construction and older properties will widen.

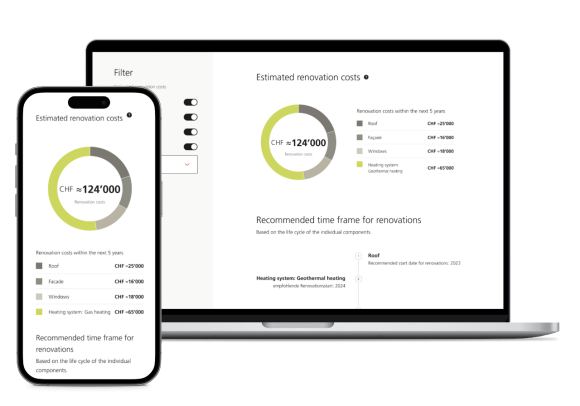

A climate-friendly renovation is worth it

Calculate your property’s estimated energy use and renovation requirements as well as its CO2 emissions free of charge in just a few steps.

It is currently hard to predict when a parliamentary consensus might be reached in a discussion that is now 20 years old. In addition, the project has already failed twice in a referendum. As only around 36 percent (as of 2021) of the population in Switzerland own their own home, most people have no interest in full or partial abolition. In the event of a further vote, a third rejection is thus not out of the question.

Until a political decision is reached, there is no way owners can avoid the taxation of imputed rental value.

Those affected are left no choice but to claim all mortgage interest and other costs for tax purposes. To do this, owners should take a close look at their deduction options. Both the calculation of the imputed rental value and the specific tax structure vary considerably from canton to canton.

What’s next for mortgage interest rates?

Our interest rate forecast gives you information each month on current interest rates and interest rate trends – free of charge by email.

Make an appointment for a non-binding consultation or call us directly if you have questions.

Disclaimer