We’re here for you

Arrange an appointment for a non-binding consultation or if you have any questions, just give us a call.

![]()

header.search.error

Buying a house or apartment

How high are the ancillary costs of owning a home? Also find out what maintenance costs you should plan for.

Content:

Before buying a home, you should first work out exactly what costs are unavoidable. Experience has shown that buyers first look at the monthly costs of interest and amortization. Many people are less aware of the fact that there are also regular maintenance and ancillary costs for the new house or apartment and how high these are. They have most likely been tenants in the past and some of these costs were hidden in the rent.

The ancillary costs of a home are the ongoing expenses incurred for utilities and the operation of building services. The most significant expenses are usually energy costs.

Maintenance costs, on the other hand, are not incurred for ongoing operations, but for the long-term maintenance of the property. The scope of the work ranges from minor repairs to major improvements or renewal of building components such as heating. If this ongoing maintenance is neglected, there is a risk of major renovation or refurbishment work later on.

Which maintenance and ancillary costs are there?

There are some typical factors that make up maintenance and ancillary costs.

How can the potential maintenance and ancillary costs be estimated?

In general, you can assume that annual maintenance and ancillary costs will amount to around 1% of the real estate value. However, this is just a rule of thumb. The concrete figure depends on the condition and age of your property. In the case of newer, energy-optimized houses, this may be less than 1% initially, whilst for older, unrenovated buildings, the figure is more likely to be 2%.

For house and apartment owners, it is a good idea to set aside a monthly amount so that major renovations do not have to be paid for directly from your income.

Before buying an existing property, it is best to ask the previous owners about their experience with ancillary costs. In the case of a condominium, you will find out from the condominium association with what value ratio you have to contribute to the common ancillary costs.

Maintenance costs vary considerably depending on the condition of the property. For house and apartment owners, it is a good idea to set aside a monthly amount so that major renovations do not have to be paid for directly from your income. If you own an apartment, you are not only responsible for the costs of renovating your own apartment, but also for a share of the costs of communal areas such as the stairway. As a rule, there will be a common fund for this purpose.

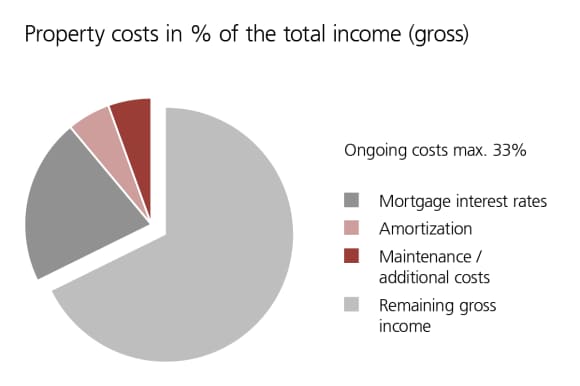

In general: taken together, the monthly imputed costs for your property should not exceed 33% of your gross income. This figure includes interest and amortization plus maintenance and ancillary costs.

Plan for interest and amortization costs

When buying a property, you should also factor in mortgage interest rates and any amortization payments.

Mortgage interest

To calculate the mortgage interest, take an imputed rate of 5%. This will ensure that you can afford your mortgage even in a period of high interest rates.

Interest rate forecast

Keep up to date with all the latest insights on interest rates.

Generally, the capital you borrow from the bank is divided into two mortgages. The first mortgage finances two thirds of the borrowed capital, while the second one finances the remainder. The second mortgage must be paid back within 15 years or before retirement. Therefore, you should budget approximately 1% of the total amount borrowed per year.

Which costs can be deducted from taxable income?

Maintenance costs

From a tax perspective, maintenance costs are normally considered “value-preserving investments.” For example, by renovating the bathroom from time to time, you will prevent the value of your home from decreasing due to ongoing wear and tear. You can deduct these investments from your taxable income

But take care: If you not only renovate your bathroom but turn it into a chic wellness temple with a Jacuzzi and other facilities, then this is considered a “value-increasing investment” in tax terms. Such expenses cannot be deducted from taxable income. It’s best to find out specifically what your canton considers to be a value-preserving expense before carrying out your renovations.

Condominium owners can deduct their contributions to the renovation fund for tax purposes, provided that these funds are only used for the maintenance costs of the community facilities. In cantons that levy a property tax, this is also deductible as a property maintenance expense.

Ancillary expenses

Only a small proportion of ancillary costs are tax-deductible, including insurance premiums and administrative costs. Energy costs for heating and electricity as well as expenses for water, wastewater and waste charges are not deductible.

The change to the system for taxing residential property was approved in the popular vote of 28 September 2025. This abolishes the imputed rental value for primary and secondary residences, severely restricts the deduction for private mortgage interest and eliminates the deduction for maintenance costs. The cantons will now have the option of introducing a cantonal property tax for owner-occupied second homes. The exact date of entry into force is not yet known. Until then, the regulations described in the article regarding tax deductions apply.

There are ways to estimate the maintenance and ancillary costs when you buy a house or apartment. You can influence the energy costs for heating and hot water, which are especially financially significant, by means of specific renovation measures. You should also calculate these costs in advance.

It is crucial that you add the maintenance and ancillary costs to the interest payments and amortizations. The total monthly costs should not exceed one-third of your income. This ensures the affordability of your home even in adverse circumstances, so your dream home does not turn into a nightmare.

Arrange an appointment for a non-binding consultation or if you have any questions, just give us a call.

Disclaimer