We’re here for you

Arrange an appointment for a non-binding consultation or if you have any questions, just give us a call.

![]()

header.search.error

When do I need a second mortgage?

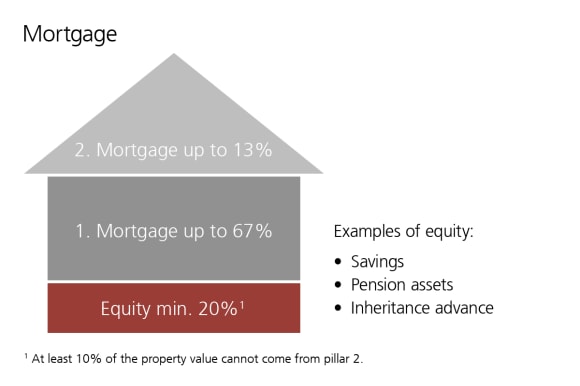

The first mortgage is limited to two thirds of the real estate value. The second mortgage, therefore, serves to finance the rest of the credit that exceeds the first mortgage.

The bank finances a maximum of 80% of the value of the property, divided into two mortgages:

Example: The purchase price is CHF 1,000,000 and the buyer has CHF 250,000 (25%) in equity. In this case, the mortgage loan would be 75%. This means that the first mortgage amounts to CHF 650,000 (65%) and the second mortgage CHF 100,000 (10%).

Second mortgage in detail

Arrange an appointment for a non-binding consultation or if you have any questions, just give us a call.