We’re here for you

Arrange an appointment for a nonbinding consultation, or if you have any questions, just give us a call.

![]()

header.search.error

Investing: bonds

During their term, bonds are subject to fluctuations in price. Learn more about the impact of changes in interest rates, the significance of duration, and the strategic alignment of bond portfolios.

Content:

If you borrow money, you have to pay interest on it. And if you invest money, you receive interest. The interest rate for a bond depends on the market interest rate and the borrower’s credit rating. Read on to learn how interest rates affect bond yields.

When bonds are issued, both the risk of the issuer (i.e., the entity issuing the securities) and the current interest rate are used as an indicator of the interest to be paid. In the case of a standard bond, this interest rate remains fixed for the entire term.

This means that if interest rates rise, existing bonds lose value because newly issued bonds pay higher yields. However, this also means that bond prices rise when interest rates fall. Long-term bonds are more susceptible to changing interest rates because the span of time until the capital is repaid is longer.

Bonds are repaid at their face value at the end of the term, except in the event of bankruptcy. This means that investors do not care whether the price of a bond changes during its term, provided they hold the bond until the maturity date.

Bonds are a very simple structured investment: An investor already knows when purchasing a bond how high the interest rate will be and when the debtor will repay it. If a fixed-interest investment is held from issue to redemption, the investor will be repaid the entire purchase price.

The value of the bond may change during its term, which may happen, for example, if general interest rates rise or fall. This has an inversely proportional effect on the value of the bond: if interest rates rise, the price of the bond falls, and if they fall, it rises.

To reduce the risk of potential price losses, we recommend diversifying securities across different terms. For a portfolio consisting of several bonds, the interest rate sensitivity can also be explained by the duration.

Know your money is in safe hands

Invest with UBS and decide how much advice you want from us and what decisions you’d rather make yourself. We look forward to assisting you

Term | Term | Duration | Duration |

|---|---|---|---|

Term |

| Duration |

|

Duration expresses how strongly bonds react to changes in market interest rates. In general, the following applies: The shorter the duration of a bond, the less volatile it is. For example, if interest rates rise by one percent, a bond with a duration of one year would lose one percent in value. For a bond with a duration of ten years, on the other hand, the loss would be ten percent. If, however, interest rates are lowered by one percent, bonds with a longer duration gain more in value than those with a shorter duration. The longer the period during which the capital is tied up, the more clearly the price of a bond will react to interest rate fluctuations.

Interest rate expectations determine the investment strategy for bonds

The interest structure can vary over time. Investors pursue different strategies depending on which direction they expect interest rates to move. The aim is to limit losses in the event of undesirable changes in interest rates and to maximize profits in the event of advantageous changes in interest rates.

A basic distinction is made between asset-based strategies and strategies that also include liabilities (e.g., of pension funds or insurance companies). In the case of the latter, the focus is on matching the interest rate risks of assets and liabilities. This is intended to protect the balance sheet against fluctuations in interest rates and is also called interest rate immunization.

Which investment strategy is the right one depends on the investor’s financial goals, risk tolerance and investment horizon. Interest rate expectations must also be factored in. Consistent adherence to the chosen strategy helps to optimize returns.

There are three options for investing in bonds: the even ladder strategy, the barbell strategy and the bullet strategy.

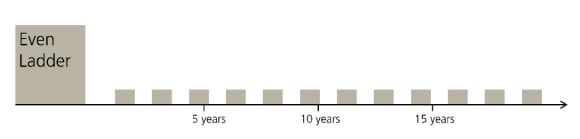

Even ladder: even distribution

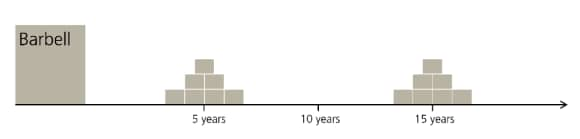

Barbell: all segments except one

Bullet: focus on one segment

To optimize the return on bonds, you should adjust your investment strategy to interest rate developments in order to protect yourself against losses when interest rates rise. The duration expresses how strongly bonds react to changes in market interest rates.

The interest structure is also important for investors. It shows the yields of similar bonds over various remaining terms. Investors can see from it what returns a bond can earn, depending on the remaining term.

Last but not least and as with other investments, we recommend diversifying when purchasing bonds considering different issuers, terms and durations.

Arrange an appointment for a nonbinding consultation, or if you have any questions, just give us a call.

Disclaimer