Your benefits with Vitainvest investment funds

Higher potential returns

Active and passive investment solutions for the 2nd and 3rd pillar with broad diversification.

No minimum deposit

Invest as much or as little as you want.

Invest sustainably

All funds take sustainability criteria into account.

Invest with Switzerland’s leading fund provider

Annual review of the UBS Vitainvest Investment Funds (in German)

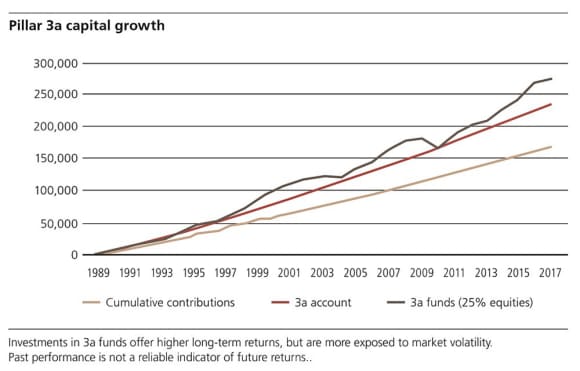

Save or invest?

In the long term, the UBS Vitainvest Investment Funds achieved significantly higher returns than a 3a retirement account, but are subject to market volatility.

Overview of UBS Vitainvest Sustainable Funds

Actively managed funds

Actively managed funds rely on in-house, forward-looking data and valuations. UBS also actively engages with companies and works to bring about improvements, including in companies’ sustainability profiles, through active dialogue and voting rights.

- Active risk management

- Short-term (tactical) asset allocation (TAA) incl. rebalancing

- Long-term (strategic) asset allocation (SAA)

Passively managed funds

With passively managed funds, the investor primarily relies on past performance. For these funds, index providers focus on historical and mostly publicly available data (including sustainability data).

- Passive risk management

- Rebalancing

- Long-term (strategic) asset allocation (SAA)

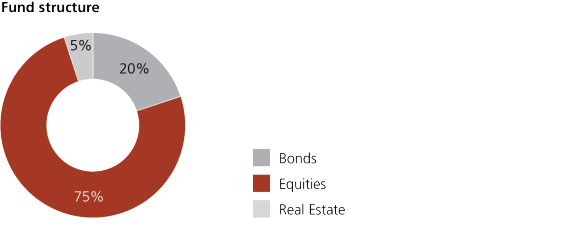

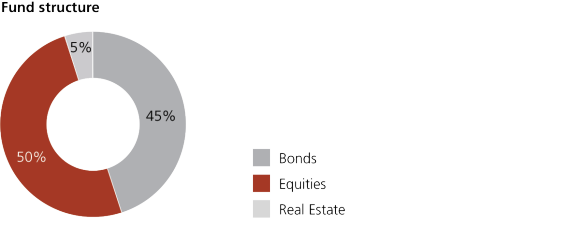

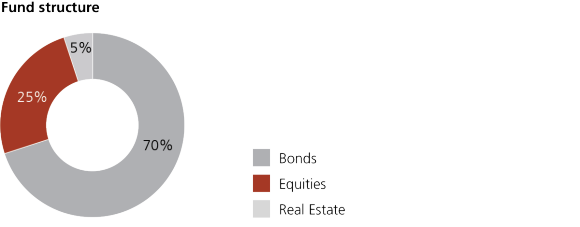

The funds in detail

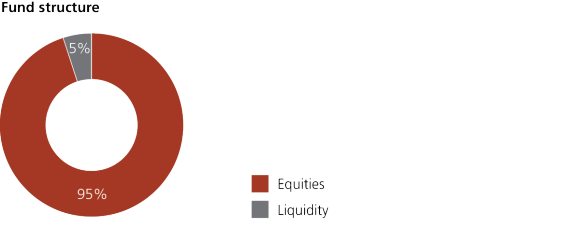

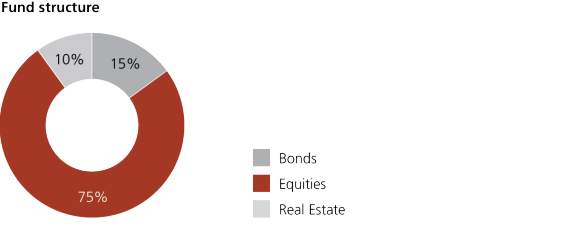

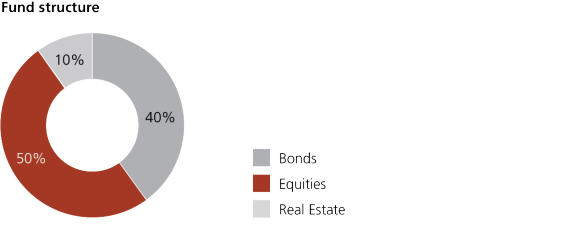

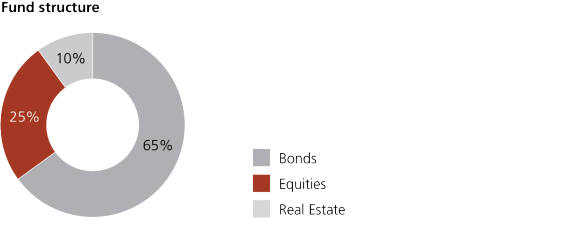

Actively managed funds

Actively managed funds

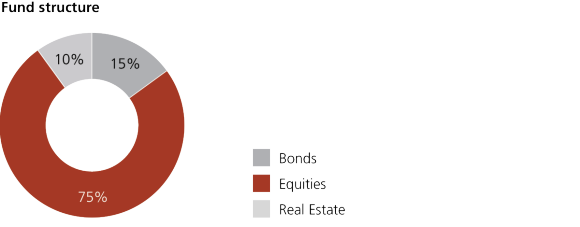

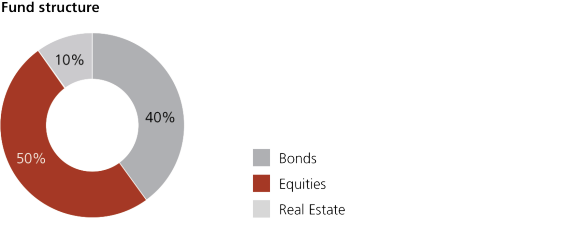

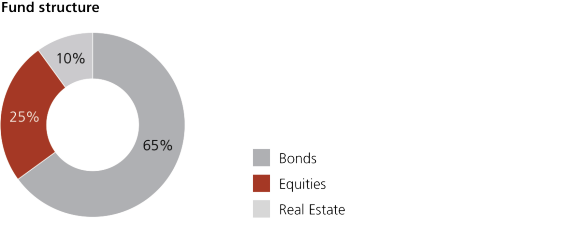

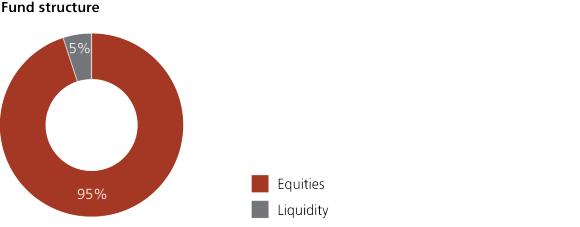

Passively managed funds

Passively managed funds

When is the right time to save for your retirement? Right now!

- 01

Define your risk profile

Answer just a few questions to find out which 3a pension solution suits you best.

- 02

Discover our recommendations

We propose different pension solutions, and you choose the one that suits you and the way you live your life.

- 03

Open your 3a pension solution

Open the 3a pension solution directly in the Mobile Banking App and choose how much and how often you would like to deposit for your future.