Background

To meet the requirements of global regulators for more transparent monitoring and prevention of money laundering, the Swiss financial market has decided that a structured disclosure of address data is necessary for payment transactions. This applies to all address fields of the parties involved (debtor, creditor and financial institutions) in a payment order, both nationally and internationally, via SIC, SWIFT and SEPA.

Who needs to do something?

Clients who create payment orders using their own accounting software (pain.001, pain.008 SDD and MT101) and transmit them to UBS must ensure that their software is updated in accordance with new market requirements so that payment orders contain structured address data by 14 November 2026 at the latest.

If payment orders are not structured in accordance with the requirements, UBS will no longer be able to process them from 14 November 2026.

Please note the following information when creating QR-bills using software.

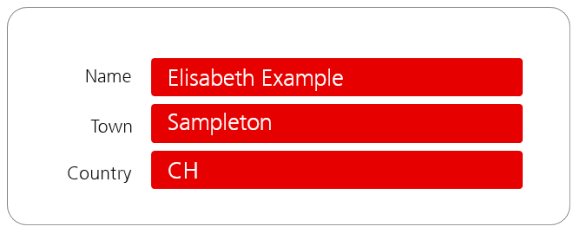

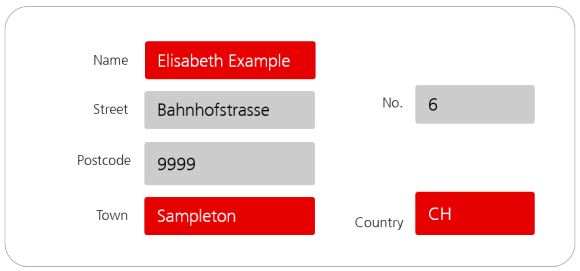

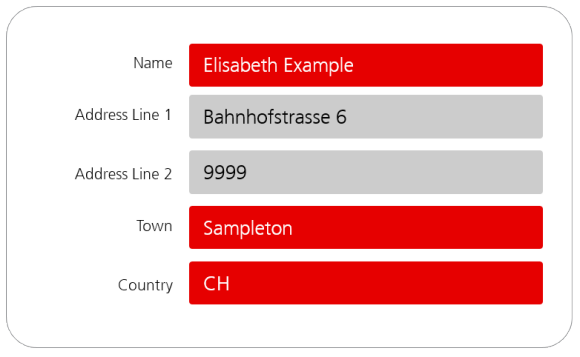

Options for structuring address data when creating the files with your own software

UBS supports three different options for structuring address data in pain.001 and pain.008 SDD payment files according to the new requirements. The requirements for SWIFT MT101 can be found below.

By when does the software need to be updated?

UBS recommends that an update be carried out at the earliest opportunity, but no later than 14 November 2026. From then on, payment files can only be transmitted using one of the structured variants described above. You will receive support from your IT department or your software partner when implementing the structuring of your address data.

Structured addresses in QR-bills

New requirements for the QR-bill come into force on 21 November 2025. From this date, only structured addresses (address type “S”) can be used in the Swiss QR code. This means that both your own address (biller) and that of the debtor (bill recipient) must be broken down into individual elements.

QR-bills created with the UBS QR portal already contain structured addresses in accordance with the new requirements.

If you are still using other software to generate QR-bills with unstructured address data (address type “K”), we recommend that you change it by 21 November 2025 at the latest. After this date, QR-bills with unstructured addresses should no longer be used for invoicing, as they can only be paid during a short transitional period. If you are not sure whether your QR-bills already use structured addresses, you can check in the UBS QR portal under “Tools for billers” whether the address type used is structured (address type “S”).

Please remember that long-term QR-bills (e.g. for the payment of leasing installments or rents) may be paid by standing order or with the help of payment templates. You should allow sufficient time for the changeover of these payments. It may be necessary to reissue such long-term QR-bills and send them to the debtors in good time.

For technical implementation, please refer to the “Implementation Guidelines QR-bill” from SIX (www.six-group.com). Your IT department or your external software partner can support you with structuring your address data.