Billers

Billers

The QR-bill explained

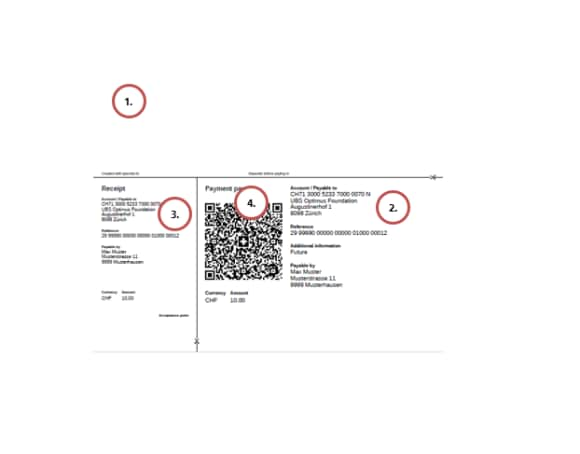

A QR-bill is an invoice with an integrated payment part and receipt. The QR-bill replaced the old orange and red payment slips on 30 September 2022.

The upper part of the QR-bill (1) is like a normal invoice; the lower part is divided into two parts just like today's payment slips: the payment part (2) and the receipt (3). The payment part includes the Swiss QR Code (4), which contains all relevant information necessary for both invoicing and payment.

The QR reference is one of two structured references used with QR-bills and must always be used with the QR-IBAN. With orange payment slips (UBS BESR or UBS BESR Quick) the ESR reference was used as a structured reference with a post office account number.

QR reference and ESR reference are structured exactly the same way and are also validated the same way.

In the “Reference” field, the 27-digit QR reference (currently the ESR reference number) or the creditor reference of up to 25 digits according to ISO 11649 are permitted. If the QR reference is chosen, the QR-IBAN must be used; if the creditor reference is chosen, the IBAN must be used.

The payment part can be sent to clients in three different ways:

- As part of a QR-bill as a hard copy (including perforation in accordance with the layout specifications)

- As a hard copy attachment to a bill (including perforation in accordance with layout specifications)

- As part of a QR-bill sent by email, e.g., in PDF format (including scissors symbol or information about separation)

- As an eBill directly into the digital banking system of the client’s financial institution (for information on the alternative procedure, see the Implementation Guidelines QR-bill).

The QR Code contains all the relevant information on the payer, amount, currency, etc. You can find a complete list in the “Swiss Implementation Guidelines QR-bills”. Please note that under “Information,” all of the values from the Swiss QR Code relevant for a payment must be printed.

Instead of the regular IBAN, the client's bank assigns them a QR-IBAN for the credit account. This is required to identify the beneficiary account. The only difference between the QR-IBAN and the IBAN is a different institution identification (IID), the QR-IID. Each legally independent financial institution participating in the procedure is assigned at least one QR-IID. The QR-IID of UBS Switzerland AG is 30005.

Example QR-IBAN with QR-IID:

Example IBAN with IID:

The Ultimate Creditor is the final payee. It is not yet possible to fill out and forward this information. However, a placeholder is anticipated in the QR code for future use of this information. Today, it is already possible to include this information in the file payment with pain.001.

The financial center will decide when this information can be delivered along with the QR-bill.

Switching to the QR-bill: planning and preparation

If you want to create and send QR-bills with your software, you should prepare by taking the following measures:

- Update your software so that it is capable of generating QR-bills according to the IGs

, Style Guide

and Grid Sheet (see Style Guide

).

- Install your own printer with perforated paper or come to an arrangement with a print shop.

- Notify UBS in order to switch to electronic reporting (camt-reporting)

If you do not have your own software, you can use the QR-Portal (developed by software company Unifits in cooperation with UBS) to generate QR-bills yourself. At the link below, you can create payment parts, download and print your own QR-bills online and print them yourself or forward them to your preferred print shop.

We recommend that you do the following:

- Review the client master data (especially the addresses): If possible, master data should be stored in a structured manner and supplemented with an account number in IBAN format as well as QR-IBAN.

- Update your invoicing solution: Ensure that your invoicing solution supports the creation of QR-bills and plan the changeover date.

- Update your software: Ensure that your software can process a notification using camt messages.

- Information to UBS: Contact your client advisor to switch to electronic notification of incoming payments from the v11 ISR credit file to camt.054.

- Inventory of forms (e.g., blank forms): Pay attention to efficient management with regard to the replacement of payment slips with the QR-bill.

If you did not manage to switch your accounting software to QR-bill before 30 September 2022, you can use the self-service UBS QR-Portal to create QR-bills yourself. In the UBS QR-Portal, you can create blank payment slips and complete QR-bills with just a few clicks, as well as download them and print them yourself (or have them printed by a print shop near you).

You can continue to provide your IBAN bank details on your invoices, which your customers can use to pay their invoices via E-Banking and Mobile Banking as well as at a UBS Multimat, including without a QR-bill.

UBS QR-bills

UBS QR-bills

QR-bills can be issued in Swiss francs and euros. The currency abbreviation CHF or EUR must be printed on the payment part below the Swiss QR Code, to the left of the amount field and on the receipt.

QR-bills with QR-IBAN and QR reference or QR-bill with IBAN and creditor reference are collectively booked according to the type of reference and currency. The collective booking details can be obtained as a camt message. The individual transactions are also visible in E-Banking. Alternatively, a paper-based notification is still offered.

If you create your invoices with software, the BESR-ID in the QR reference must be used during the parallel phase of orange payment slips and QR-bill. If you don’t already have a BESR-ID, please apply to UBS Switzerland AG for the new identification number (ID no.) for the QR references.

Use the UBS QR-Portal to create QR-bills yourself with just a few clicks. UBS does not offer a service for ordering payment slips.

Creating the QR-bill

Creating the QR-bill

It should also be noted that the details of the beneficiary must correspond with the client data kept with UBS. Deviations between the address in the “Payable to” field and the domicile address or the address kept with UBS may result in the rejection of the payment.

You can use the Grid Sheet (see Style Guide) to make a manual check and can check the data content of the QR code on the UBS test platform.

The test platform is particularly suitable for software manufacturers. You can also simulate credit entries here.

We have made a form test for QR-bills available to you free of charge. We strongly recommend that you send us samples of your QR-bills to the following address before sending them out for the first time:

UBS Switzerland AG

Client Lifecycle Services

E-Contracts

Postfach

CH-8098 Zurich

Please note that requirements in accordance with the Swiss Implementation Guidelines QR-bill must be complied with. For assistance, please refer to the UBS brochure for the QR-bill

.

No. If information on the amount and the bill payer is not printed at the time of invoicing, colorless text boxes with corner marks must be added in both the payment part and in the receipt so they can be edited by hand. For further information, see the “Swiss Implementation Guidelines QR-bill"

Yes, the field “Additional information” contains up to 140 characters. Additional information may be used for all three versions. Unstructured information may be used to specify a payment purpose or to provide additional textual information on structured reference payments under “Additional information.” This must be filled out in advance and cannot be filled in with handwritten text anymore.

If you already use a BESR-ID, you should have received a letter with your QR-IBAN from UBS in the second quarter of 2020. All new clients must apply for their QR-IBAN with UBS and will also be assigned a six-digit ID number. Please only use this six-digit ID number in the first six digits of the QR reference.

Alternatively, you can find your QR-IBAN with just a few clicks in our UBS QR-Portal under “Other tools” > "QR-IBAN and references". There you can generate the corresponding QR-IBAN based on your IBAN.

Yes. The “Swiss Implementation Guidelines QR-bill” must be complied with.

Yes, however the amount quoted must always be specified numerically with decimal separator and two decimal places; in this case the amount is to be specified with “0.00” and the text “DO NOT USE FOR PAYMENT” must be included under “Additional information.”

Yes, the field “additional information” contains up to 140 characters. Additional information can be used with all three versions of the QR-bill, in the form of unstructured messages or billing information.

The information used there must be printed on the payment part to the right of the Swiss QR Code. Handwritten additions are no longer permitted.

Unstructured notifications may be used to specify a payment purpose or to provide additional text information on structured reference payments. This data is forwarded with the payment by scanning the QR code.

Billing information contains coded information for the automated booking of the payment. This data is not forwarded with the payment, and the data is an advantage for automated accounts payable processing.

If an invoice is created with the payment part and receipt integrated into the form, advertising is not permitted in the payment part and receipt.

However, advertising is allowed in the freely designable invoice part above the perforation.

- You can enter your IBAN on your invoice as your bank details.

- You can also go to a print shop; many print shops offer to print out QR-bills as service.

Printing a QR-bill

Printing a QR-bill

The QR-bill, including payment part and receipt, can be created with commercially available printers.

For printing, natural white or white paper, weighing 80 to 100 g/m2 can be used. Tested recycling, FSC and TCF paper grades are allowed; coated or reflective grades are not permitted.

Approved fonts are the sans serif fonts Arial, Frutiger, Helvetica and Liberations Sans, in black and neither italicized nor underlined. Font size: minimum 6 pt. and maximum 10 pt.

For more details about printing specifications, see “Swiss Implementation Guidelines for the QR-bill.”

A perforation of the payment part is mandatory if the QR-bill is to be printed and sent. If the QR-bill with payment part and receipt or the payment part with receipt are created separately as a PDF document and sent electronically, the format A6 of the payment part and the receipt on the left must be marked by lines. In addition, a scissor symbol must be added to each of these lines or alternatively the note “Separate before paying in” must be added above the line (outside the payment part). Details on specifications can be found in the IG for QR-bills.

Costs

Costs

The prices are set by the post office and published on postfinance.ch (German).

By choosing to pay the amount at the post office counter, the payer or debtor instructs the fees to be charged to the QR biller.

Invoice recipient

Invoice recipient

Planning and preparation per payment channel

Please consult our checklist for bill payers. This will give you an overview of when you need to take further steps.

Since 30 June 2020, you can also pay QR-bills as usual if you use our online services Mobile Banking, E-Banking, Multimat, use the paper order via UBS easy forms, use standing order paper or order payments via your client advisor.

If you use one of the UBS interfaces and thus create the invoice beforehand using software, you must update your software and, if necessary, your invoice scanners or entire accounts payable processes before paying with QR-bill.

Paying QR-bills

- With payment software: If you use a payment software, you can continue to pay QR bills easily. To do so, you need to update your software to be able to pay all three versions of QR-bills.

- In Digital Banking: The easiest way to pay a QR-bill is digitally in E-Banking or the Mobile Banking App. Simply scan the QR code with your smartphone or computer camera to trigger the payment. Your computer doesn’t have a camera? You can enter the QR-bill manually in E-Banking (Payments > Transfer money and pay invoices > New payment > QR payment). You can also upload a QR-bill received via email directly to E-Banking.

- On a UBS Multimat: If you don't have access to Digital Banking, you can also pay the QR-bill at a Multimat (camera available) at your nearest branch. Simply scan the QR code and initiate the payments.

- Paper-based payment: If you don't have Digital Banking and don't want to pay at a UBS Multimat, you can pay the QR-bill either at a post office branch or also with UBS easy or easy international. Fill out the order form and submit it with the payment section of the QR-bill.

Yes, if you do not have access to one of our online services, you can pay QR-bills as usual at the post office counter (postal agencies or branches) in the same way as today's payment slips. For QR-bills, we also offer you the now-familiar payment orders via UBS easy forms, as well as via paper standing orders or client advisors.

Please enter the missing information by hand or in UBS Digital Banking using your keyboard.

For paper payment orders, handwritten additions are allowed for two items of information if they are missing:

- amount

- payable by (name/address)

For all other pre-printed information on the QR-bill, handwritten additions for UBS easy, UBS easy international and paper standing order will be ignored. Instead, the payment will be executed with the information as entered on the QR-bill. In certain cases, this can also lead to the payment being rejected. For a one-time order, payments will be made according to your order.

Please always use the account number printed on the payment part when paying the QR-bill. The account number is always in IBAN format. This may differ from the biller's usual IBAN if the new QR-IBAN is used in connection with a 27-digit reference.

The Ultimate Creditor is the final payee. The inclusion and forwarding of this information is not yet possible, but a placeholder is provided for future use of this information in the QR Code. This information can already be included in the file payment with pain.001.

The financial center will decide from which date this information can be delivered with the QR-bill.

If, despite this, this information is included in the QR-bill, the payment will still be made, but this information will not be included. In the case of pain.001 payments, this cannot be prevented.

The Ultimate Debtor is the person who receives the QR-bill, i.e., the bill payer. The institute of the debtor must forward the bill payer’s data to the institute of the payee according to the agreement with the debtor. This is done provided that the debtor transmits this data in the payment order. The bill payer’s data is forwarded except in cases where there are instructions to the contrary, or in cases where special agreements with the debtor make it impossible to forward the data.

The bill payer is optional information that is not required to execute the payment. It can be omitted when making the payment.

This option is present in UBS Digital Banking and UBS Multimats. In the case of the hard copy orders UBS easy and UBS easy International and standing order, all of the information printed on the payment part or information that is allowed to be filled in by hand is always forwarded with the payment regardless of whether it is necessary to execute the payment. Handwritten additions (but not crossed-out text) are only allowed if there is a missing amount and/or bill payer under “Payable by.”

If the payer doesn’t want this, they can use the alternative payment options UBS Multimat, UBS E-Banking or one-time order. These channels enable the payer to process the information of the bill payer in the payment order and to omit or delete it if necessary.

If the payer doesn’t want this, you can use the alternative payment options UBS Multimat, UBS Digital Banking or one-time order. These channels enable you to process the information on the bill recipient in the payment order and to omit or delete it if necessary.

UBS offer for payment of QR-bills

Yes, the payment part can be included with a payment order in paper format. The requirement is that the QR-bill is already filled with a minimum of information, i.e., account/payable to and currency. If the amount is missing, it must be added manually. Payment is then possible with the following orders:

- UBS easy for CHF

- UBS easy international for EUR

- Hard copy standing order

- One-time order (letter, email, telephone)

Please note that for payment orders with UBS easy forms and hard copy standing orders, all of the information printed on the payment part or information that is allowed to be filled in by hand is always forwarded with the payment regardless of whether it is necessary to execute the payment. Handwritten additions (but not crossed-out text) are only allowed if there is a missing amount and/or bill payer under “Payable by.”

The payment part must be separated from the QR-bill using a pair of scissors. Afterwards, the payment part without receipt can be attached to a payment order as a hard copy.

Please note that for payment orders with UBS easy forms and hard copy standing orders, all of the information printed on the payment part or information that is allowed to be filled in by hand is always forwarded with the payment regardless of whether it is necessary to execute the payment. Handwritten additions (but not crossed-out text) are only allowed if there is a missing amount and/or bill payer under “Payable by.”

Reporting (account statement, debit display, standing order)

Reporting (account statement, debit display, standing order)

There are no new reports specific to the new QR-bill. The existing debit displays will continue to be available to clients for all payments. The existing debit displays will continue to be available to you for all payments.

We’ve ensured that when a QR-bill is paid, the information is also displayed in the relevant report. The only restrictions concern how the payment is displayed:

- Physical: On QR-bills without a reference, the bill recipient “Payable by” is also displayed because the payment cannot be identified as a QR-bill.

- Online: In UBS Digital Banking, account movements are displayed without details for the time being. However, all information is available in the recorded payments and can be downloaded as a PDF.

Costs

Costs

No. The QR-bill can be submitted via all existing channels at UBS and the price for the channel selected is then charged.